There are downsides to everything; there are unintended consequences to everything.

-Steve Jobs

Discovering Unintended Consequences

After closing the first half of 2021, we are beginning to get a glimpse of some of the unintended consequences that may lie ahead following the unprecedented measures taken to address a once-in-a-century pandemic. The idea of unintended consequences was first introduced to the world in the middle of the Enlightenment by the preeminent John Locke, who argued in 1692 against a parliamentary bill that would cut the maximum permissible interest rate from 6% to 4%. Locke submitted that the reduction in rates could actually end up hurting borrowers rather than help them over the long term.

Now more than three centuries later, we engage in a similar debate and wonder whether artificially low rates combined with unlimited bond purchasing may be causing more harm than good. So far, while the sweeping measures have certainly contributed to stimulating the overall economy and accelerating the recovery, the accompanied jump in stock markets and home prices have also served to exacerbate wealth inequality. Furthermore, supply chain imbalances, labor shortages, changes in landlord laws, and how and where we work are just a few among many other unintended consequences we are experiencing as we move forward.

The Return of Inflation

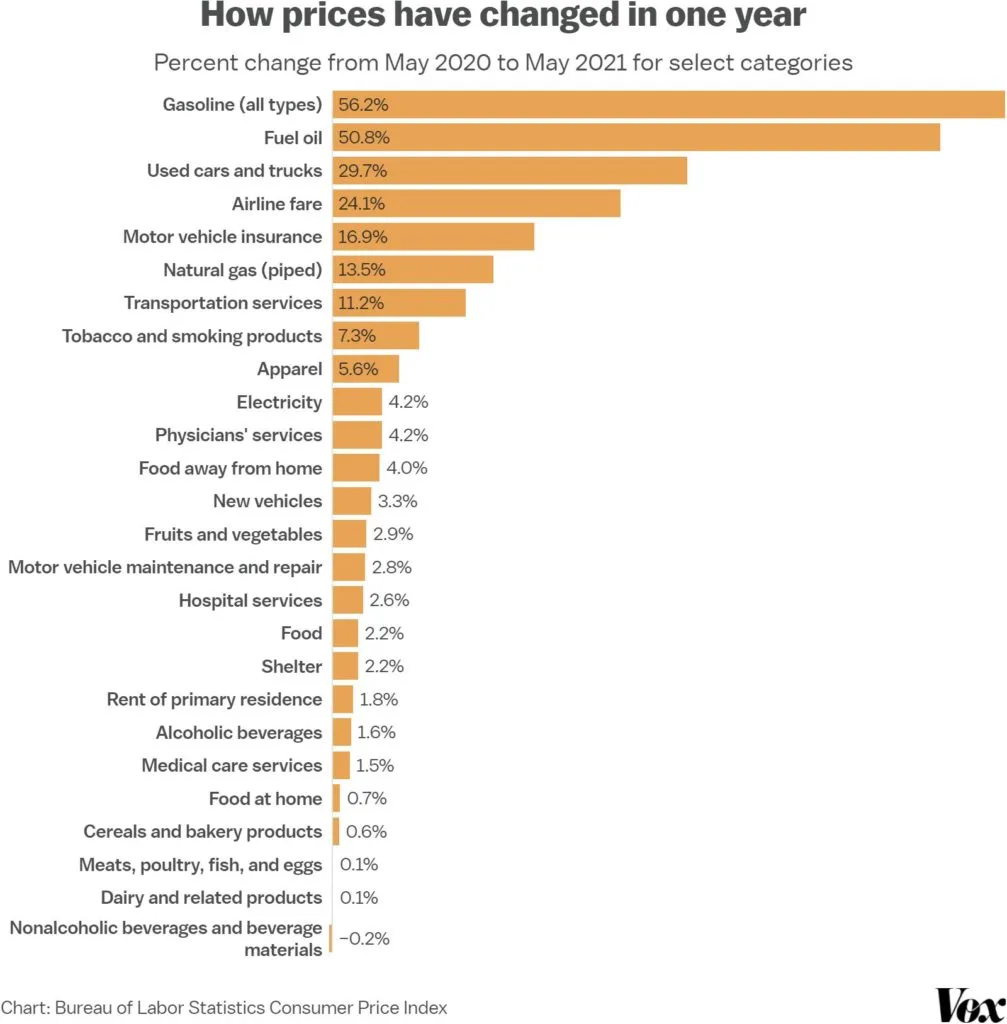

Much of what has driven that widening amongst the rich and poor can be attributed to a significant pickup in inflation, which author James Cook described, “Inflation makes the wealthiest people richer and the masses poorer.” The most recent report from the Bureau of Labor Statistics (BLS) indicated that the consumer price index rose by 5.0% in May from a year ago, the largest expansion since August 2008. It is worth noting, however, that while the headline figure alarmed some, much of the increase can be attributed to the negative inflation experienced last spring. In fact, the most significant price changes that have occurred over the last 12 months have primarily been centered around the energy and transportation sectors—specifically related to automobiles, fuel prices, and travel costs. This is why many economists believe the recent surge in inflation we are experiencing is largely transitory and is expected to stabilize in the coming years.

Inflation Fears Gradually Receding

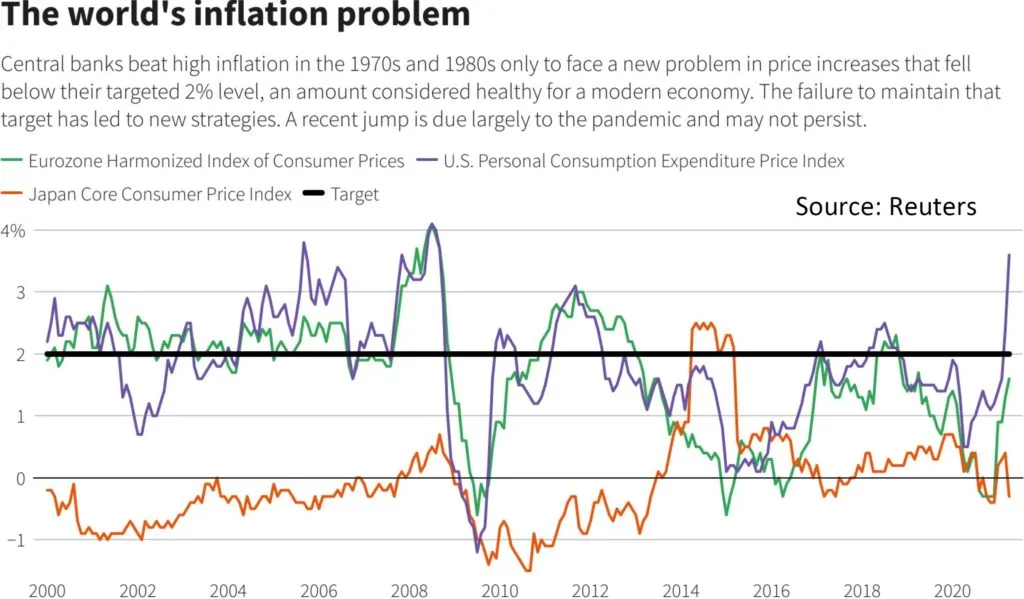

That is not to say that the inflation readings this year have not caught many economists by surprise. Even at the recent June 15-16 Federal Reserve meeting, senior central bankers admitted being caught off guard by the magnitude of the jump in inflation, with the meeting minutes indicating that they “attributed the upside surprise to more widespread supply constraints in product and labor markets than they had anticipated and to a larger-than-expected surge in consumer demand as the economy reopened.” Consequently, the Fed increased its 2021 PCE inflation target from 1.8% to 3.4%, but expects it will slow to 2.1% in 2022. Fed Chairman Jay Powell has maintained a consistent tone that inflation will likely wane in the coming years, and while the bond market sold off earlier this year, rates have pulled back to reflect a similar view. 10-year and 30-year treasury yields have fallen considerably from their highs in March.

Although inflation in the United States has been more pronounced than many other developed economies, the inflation phenomenon has been worldwide. Most other central bankers around the world also share Mr. Powell’s opinion. In recent days, German Finance Minister Olaf Scholz was quoted as saying, “We are looking at this development of inflation… all experts, all the central bankers around the globe say it is temporary.”

Already many economies are starting to experience varying degrees of slowdown from earlier levels of activity this year, generally not attributed to a lack of demand but a lack of product due to supply bottlenecks. For this reason, the Fed is keeping its accommodative monetary policy and for now will hold off tapering and maintain its monthly purchase of $120 billion bonds. While a few Fed officials have not ruled out a 2022 rate hike, the general view is that the next rate increase will not occur until 2023.

The Most Critical Bottleneck

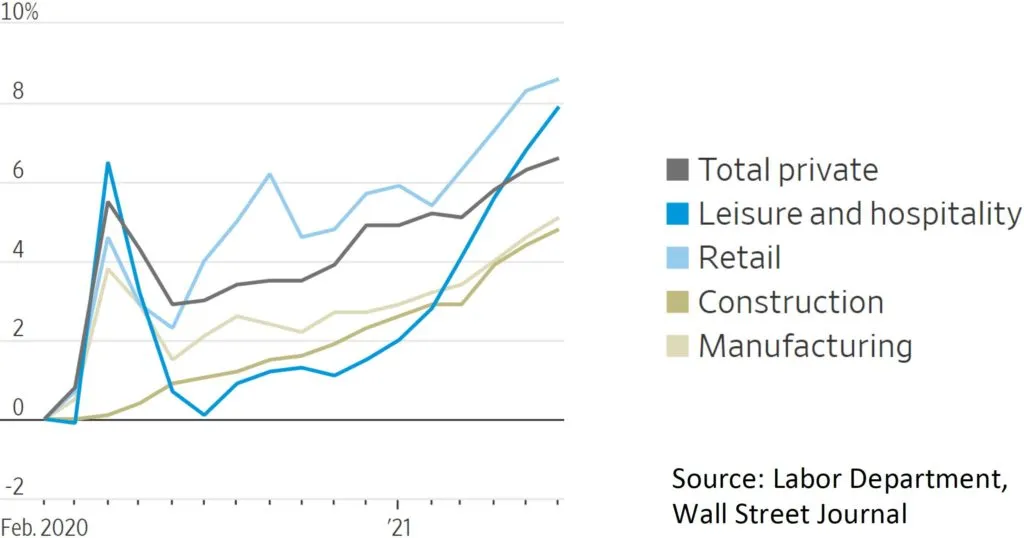

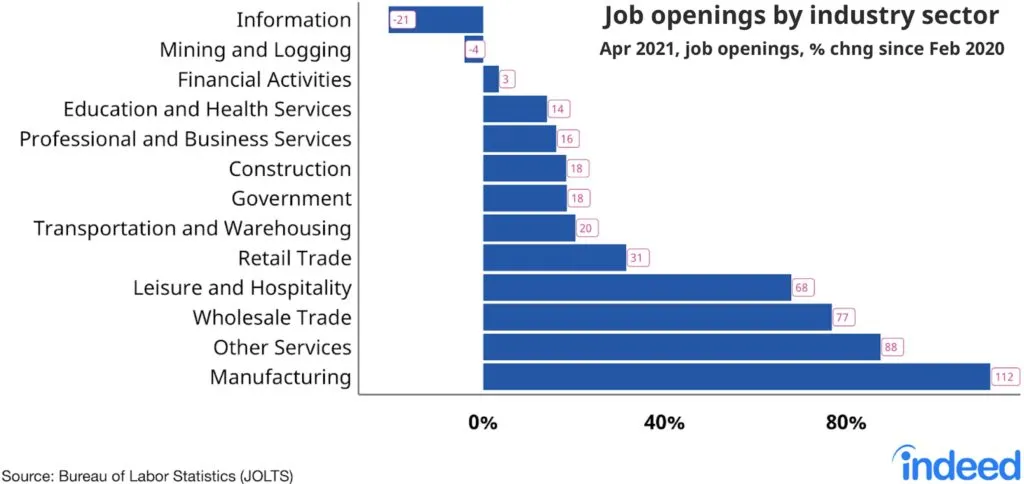

The most essential supply shortage, though, may be human capital. Last week, the Labor Department reported the U.S. had more than 9.2 million job openings in May, compared to 7 million prior to the pandemic, and workers are looking for higher pay to address many years of relatively stagnant wages. According to the Federal Reserve Bank of New York, the “reservation” wage (lowest pay for which someone is willing to work) for non-degree workers rose 17% from late-2019. Consequently, wages rose in May by the most since 1983 – the largest gains coming in restaurants, hospitality, and retail.

A Worker Shortage, or Something Else?

Yet despite higher wages, employers are struggling to hire workers. It may come as a surprise, then, that there are also over 9 million Americans looking for jobs who can’t find them. So why is that? Is there actually a shortage of labor or do employers just need to pay more? While pay plays a big part, there are also other factors at force. Many workers moved during the pandemic and there is now a mismatch between available jobs and the people who can fill them. A survey from ZipRecruiter indicated that 70% of job seekers who last worked in leisure and hospitality are now pursuing work in a different industry and 55% of job applicants want to work remotely. There is also the issue of increased unemployment benefits giving workers more time to be selective about the jobs they would accept.

Socioeconomic Forces Playing into Policy

With significant discussion around a large jump in the wealth gap and wages finally seeing real growth, the Biden administration has taken a bolder approach in proposing a $2.25 trillion American Jobs Plan and a $1.8 trillion American Families Plan, these coming on the heels of the $1.9 trillion American Rescue Plan that was already enacted in March. These two new plans, which the White House hopes to fund through a dramatic tax overhaul on individuals, corporations, and estates, are already facing significant pushback from the GOP.

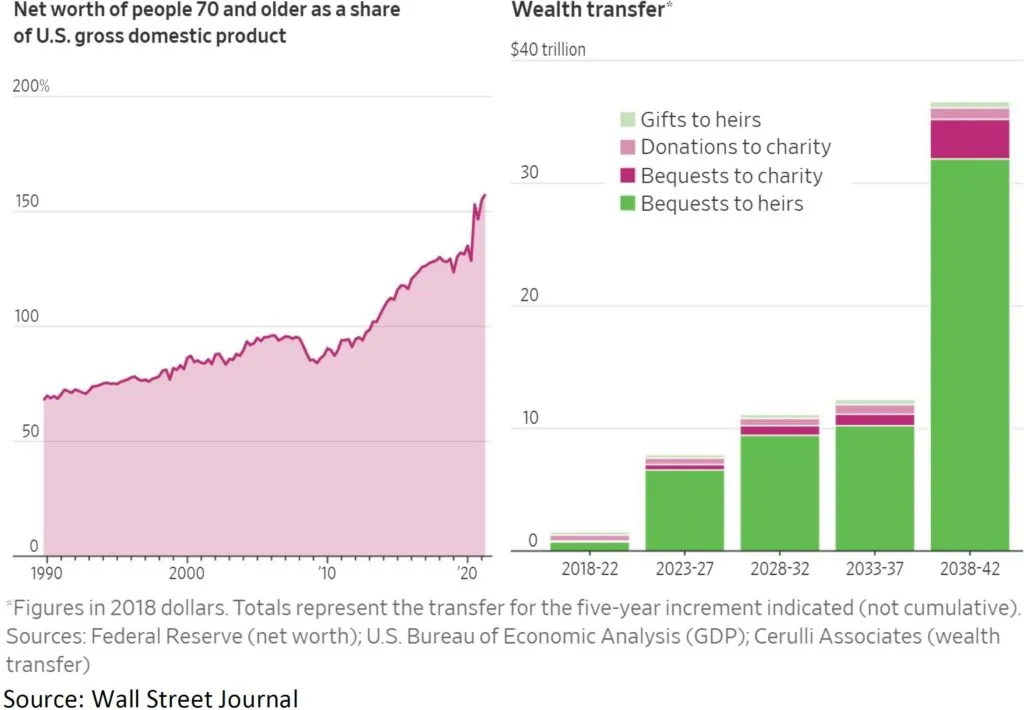

Accelerating the Transfer of Wealth to Next Gen

The prospect of higher taxes is encouraging older Americans to begin handing over some of their wealth to younger generations sooner. Federal data shows Americans age 70 and above had a net worth of $35 trillion at the end of March, amounting to 27% of all US wealth (compared to 20% three decades ago) and 157% of US GDP (double the proportion 30 years ago).

According to consulting firm, Cerulli Associates, older generations will hand down approximately $70 trillion between 2018 and 2042, with $61 trillion going to heirs and the remainder to philanthropy. With the higher 2018 gift tax exemption scheduled to roll back in 2026, and the Biden proposal to eliminate the basis step up at death, the Wall Street Journal reported, “Now they have started parceling it out to their heirs and others, unleashing a torrent of economic activity including buying homes, starting businesses, and giving to charity. And many recipients are guided by different priorities and politics than their givers.” The impact of the timing and manner of this wealth transfer may reverberate for years to come.

A Resilient Economy

The US has rebounded considerably faster than most had expected and data has been very positive from a number of directions. The economy added 850,000 jobs in June and over 3.2 million jobs since the start of the year, bringing the unemployment rate down to 5.9% from 14.8% last April. Most economists anticipate the US will be back to full employment before the end of the year. Moreover, the International Monetary Fund (IMF) raised its US GDP forecast to 7.0% for 2021 (from an April projection of 4.9%) and expects the US to grow 4.9% in 2022 (from a previous 3.5% target).

Earnings have also been very strong so far this year. In the first quarter, according to FactSet, earnings grew by 52.1% from a year ago and are expected to grow 64% in the second quarter, lifting the full-year earnings per share (EPS) estimate for 2021 to $191.49. If realized, this would far exceed pre-pandemic levels and would be over 17% higher than 2019.

Consumer sentiment, which accounts for roughly 70% of economic activity, has risen consistently to a 16-month high. Despite supply chain challenges and labor shortages, manufacturing activity has risen for 12 straight months and industrial production for seven of the last eight months. Given the bevy of positive data in the first half of the year, it may come as no great surprise that the stock market posted its second-best first half in 23 years.

New Day, New Environment

For most places, while life now more closely resembles to the one we left in early 2020, there have been decisions made and forces occurring that make the future look different than what otherwise might have been. A powerfully rebounding economy, soaring home prices, and a jump in stocks, while good for many, may bring some downsides as well. It is hard to predict the societal repercussions that will result from actions taken over the last several months, but as Steve Jobs aptly reminded us, “There are unintended consequences to everything.”