“You, me, or nobody is gonna hit as hard as life. But it ain’t about how hard ya hit. It’s about how hard you can get hit and keep moving forward. How much you can take and keep moving forward.”

– Rocky Balboa

Getting Up Off the Mat

This past Q2, the US stock market wrapped up its best quarter since 1998; picking itself up after suffering its worst month in March since 1931 and recovering the majority of the year’s losses. Perhaps even more surprising than the intensity of the selloff was the rapid pace of the recovery. With unemployment at its highest in nearly a century and the economy slowing to its most anemic levels since World War II, the huge bounce back in stocks these last few months caught many off guard.

This is evident from the record amount of cash that has been pulled from riskier stocks and bonds and plowed into money market funds; which as of mid-June totaled $4.62 trillion according to the Wall Street Journal. This figure crushes the previous record of $3.76 trillion that was held in money markets following 2008’s Global Financial Crisis. With stocks now nearly flat for the year, many are left wondering whether we just experienced a giant dead cat bounce or if another major selloff looms in the horizon.

Can the Jobs Continue to Come Back?

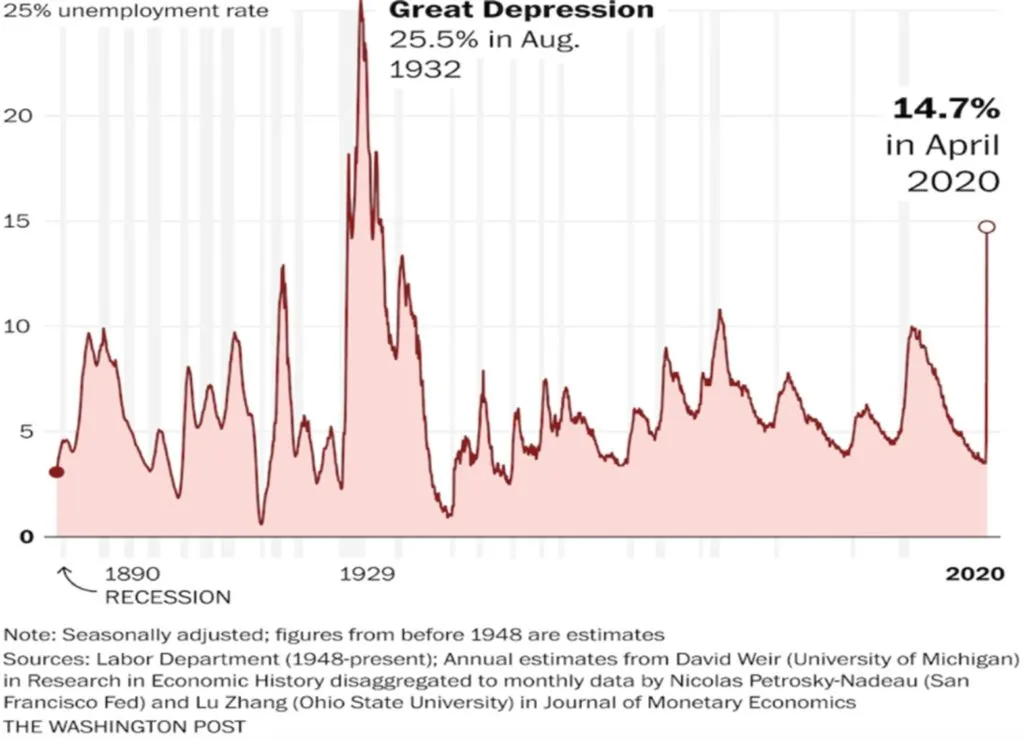

Nearly 49 million jobless claims have been filed since the start of the pandemic. By April, US unemployment had already reached its highest levels since the Great Depression.

Since then, US employment improved in May and June, with the unemployment rate falling to 13.3% and 11.1% in May and June, respectively. A couple of key issues may significantly impact jobs in the coming months. Firstly, the additional $600 weekly provision on top of the normal unemployment benefits arising from the CARES Act will be expiring at the end of July. Critics have observed that companies have been facing difficulties with recruitment, and Treasury Secretary, Steve Mnuchin, has said that unemployment benefits will be capped in the next coronavirus package to ensure that benefits will not exceed former wages. While the limitation may help bring back some blue-collar jobs, white-collar jobs may be at risk under another CARES Act program. Companies that obtained loans under the Payroll Protection Program (PPP) can begin filing for loan forgiveness in the coming weeks. While they have been compelled to keep workers employed to avoid the need to pay back their debt, once the loans are forgiven there is the prospect that companies may look to reduce payroll.

the next wave

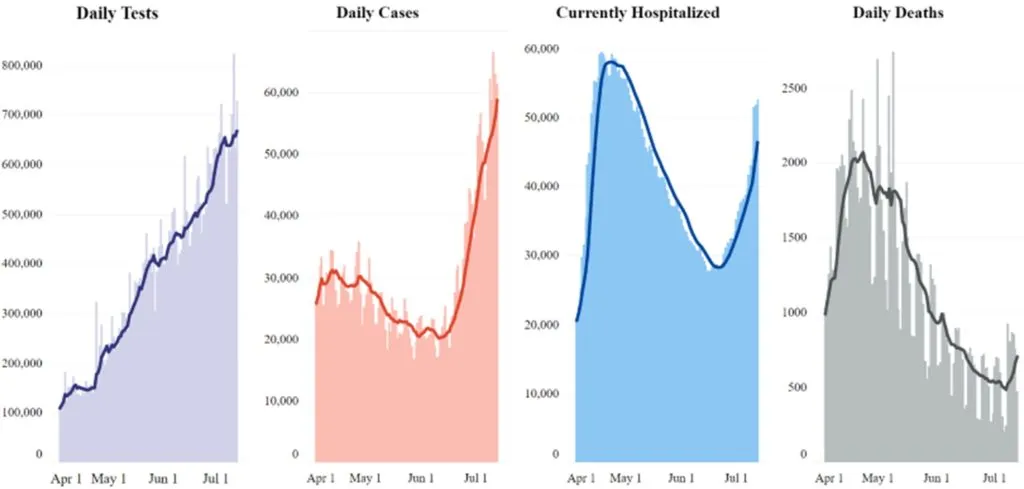

Likely the greater stumbling block to jobs being restored, though, is the jump in coronavirus cases again. After daily reported new cases trended down from April through mid-June, cases have spiked since. The number of daily reported cases, which fell to around 20,000 in June, have now roughly tripled to 60,000 currently. While there is debate as to whether the jump in cases is attributed to expanded testing (daily testing increased from 100,000 to 700,000 between Apr 1 and July 1) as opposed to a real flood of new infections (both are likely true), the reports at the very least suggest the country likely remains far from stomping out the virus anytime soon.

Reported daily deaths, by comparison, have been relatively flat but started picking up in recent days. Several states are reporting record daily death tolls including California, Texas, Florida, Arizona, Mississippi, Tennessee, South Carolina, and Alaska. As many states roll back reopening guidelines and increase social distancing policies once again, the desperate need for a vaccine comes in focus. According to the WHO, there are 21 candidates in human clinical trials, three of which are in the third phase of testing; including US biotech company Moderna, the UK’s AstraZeneca, and China’s Sinovac Biotech.

Expect Record Economic Decline for Q2

While the advance Q2 GDP report is not scheduled for release until July 30 and the official figure until October 2, current forecasts anticipate a record decline for the past quarter.

GDP Tracking Estimates, Annualized % Change (2020 Q2)

| LOWEST AND HIGHEST ESTIMATES | -38.1% to -26.7% |

| AVERAGE OF ESTIMATES | -34.7% |

| # OF ESTIMATES | 10 |

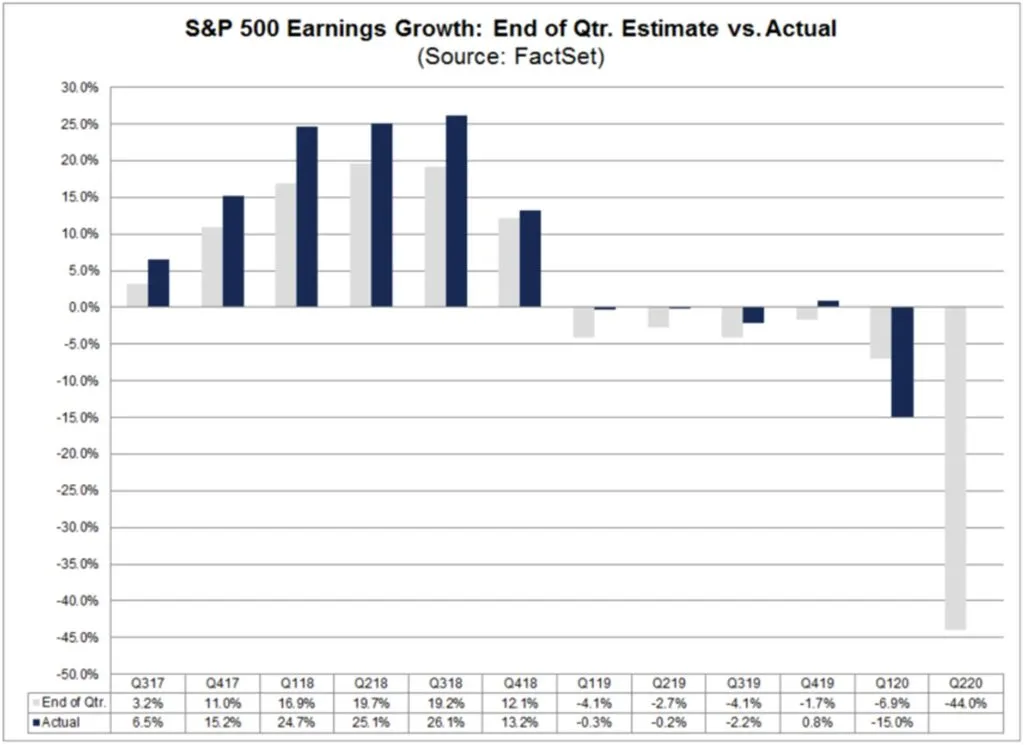

Opening Pandora's Box

This is the earnings season we have been waiting for, to find out just how bad things actually got. The street is estimating that earnings for the 2nd quarter will have fallen 44.6% compared to a year ago, which would be the worst since the 4th quarter of 2008, when S&P earnings fell 69.1%. Yet despite all of this, industry analysts are now predicting the S&P to close above 3350 in the next 12 months as the general expectation is the economy should rebound sharply in the coming quarters.

US and China at Odds Once Again

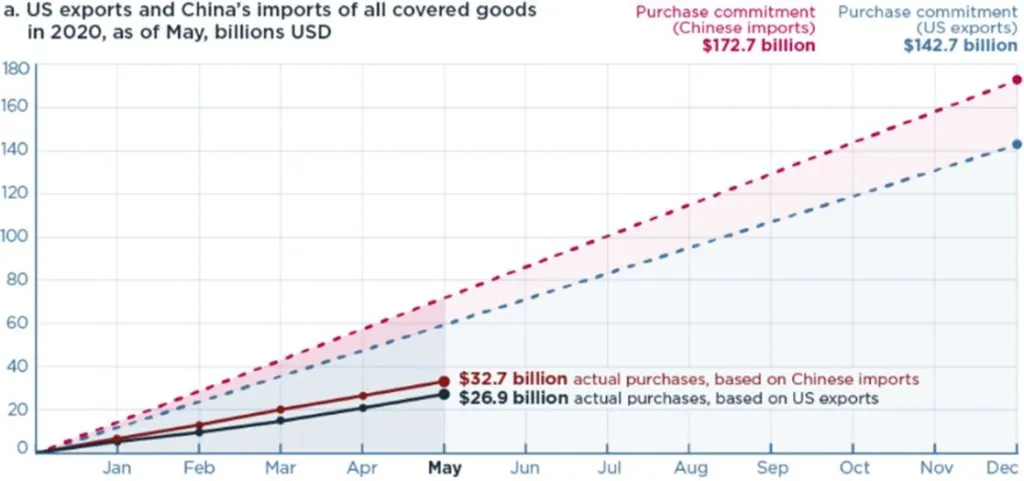

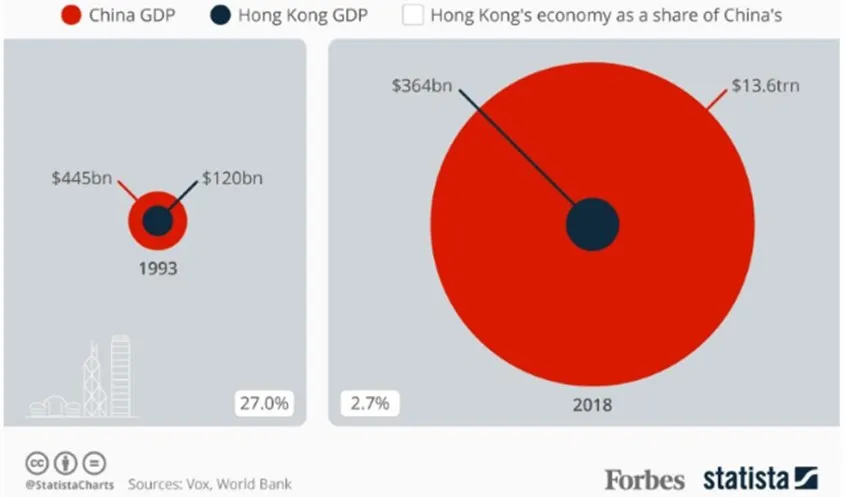

After agreeing to a Phase One deal in January, the US and China find themselves at odds with each other again. Through May, China had bought only 45% of its scheduled target of US goods.

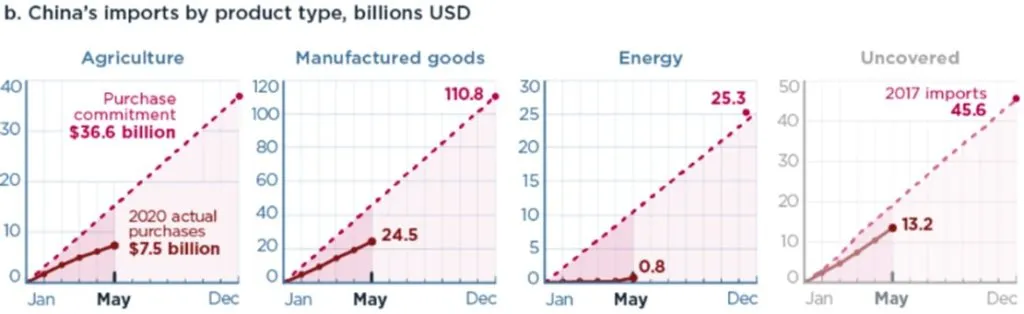

At the end of May, Secretary of State, Mike Pompeo, warned Hong Kong’s special trading status with the US could be removed. Since then, China passed a broad national security law that criminalizes dissent in Hong Kong, demonstrating its lack of reliance on the territory’s economy.

The two countries met in Hawaii on June 19, where Secretary Pompeo said China recommitted to completing and honoring its Phase One obligations. This would require a significant acceleration in the purchase of US goods and many Washington insiders remain skeptical, according to the WSJ. For now, any discussion of a Phase Two deal is off the table, according to President Trump; who says the relationship between the two nations has been “severely damaged” by the pandemic.

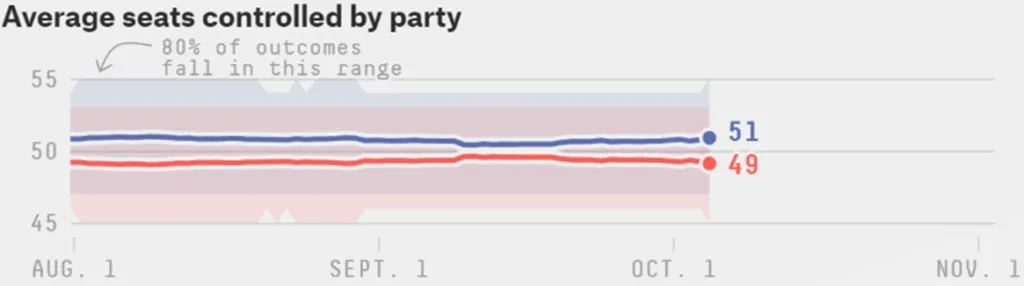

A Widening Lead in the Polls

Joe Biden has a built large lead in the polls of 9.6 points (as of June 25), the biggest since Bill Clinton in 1996. Public skepticism of the polls is understandable, given the presidential outcome of 2016, where Hillary Clinton built up as much as a 7.5 point and lost the election. Biden’s new economic plan proposes raising corporate taxes to 28% (halfway between the rate before Trump and its current level), raising the top personal tax rate from 37% to 39.6%, raising capital-gains taxes, eliminating some tax deductions for wealthy Americans, and implementing a new Social Security tax that would apply at high income levels. On trade, Biden supports NAFTA and was for permanent normal trade relations with China and he previously supported the Trans-Pacific Partnership (TPP); which he now says he would look to renegotiate rather than simply reinstate. With four months to go until Election Day, however, his lead is not insurmountable. Michael Dukakis led nationally by almost 5 points in 1988 but ended up losing by nearly 8 points. George W. Bush led by nearly 8 points leading up to the election but narrowly lost the popular vote (but won the Electoral College). Investors will be watching closely as we near November.

Final Thoughts

With US stocks having almost fully recovered for the year, we believe considerable optimism has already been priced into the market. While visibility regarding future US profits is more opaque than usual, the current forward P/E multiple (based on earnings estimates over the next 12 months) on the S&P is at 22.0, its highest level since the early 2000s.

While we are hopeful profits do return quickly and a vaccine is completed soon, neither of these outcomes is guaranteed. Additionally, our relationship with China remains complicated and corporate taxes may be on the rise if Biden does indeed win November’s election, which would reduce corporate earnings and be negative for stocks. At current levels, we believe investor caution is more warranted than investor optimism.