Success Breeds Complacency

Card experts have warned that a winning hand can often lead to overconfidence and complacency, causing players to take unnecessary risks and become careless. Those missteps arising from sloppy play can lead to trouble when playing future hands.

In the first half of 2024, the US economy has been dealt an exceptional hand, holding a combination of full employment, accelerating labor productivity, and moderating inflation without sacrificing growth. In fact, according to the International Monetary Fund (IMF), the United States is the only G-20 economy whose GDP growth exceeds its pre-Pandemic level.

This has led to some remarkably effusive observations of the US economy. Bank of America said the US is on the path to a “Goldilocks” scenario for the year. Steve Eisman, famously portrayed in The Big Short, says, “the US economy is more dynamic than it’s ever been in its history,” and The Atlantic published an article entitled, “The U.S. Economy Reaches Superstar Status.”

Such praise may only serve to reinforce the notion of American Exceptionalism. To the surprise of many including this author, despite the US’s liberal use of both fiscal and monetary relief measures during the pandemic that ballooned the US debt and set off an inflation panic, the US has not had to pay an economic price for it… yet. In fact, if anything the US has become even more emboldened—further widening the federal deficit and expanding its fiscal gap to levels typically reserved for wartime or recessionary periods.

While its hand is strong for now, the US must be careful not to get careless. Such complacency could lead to future problems that may be less visible now.

Charging Forward Against the Headwinds

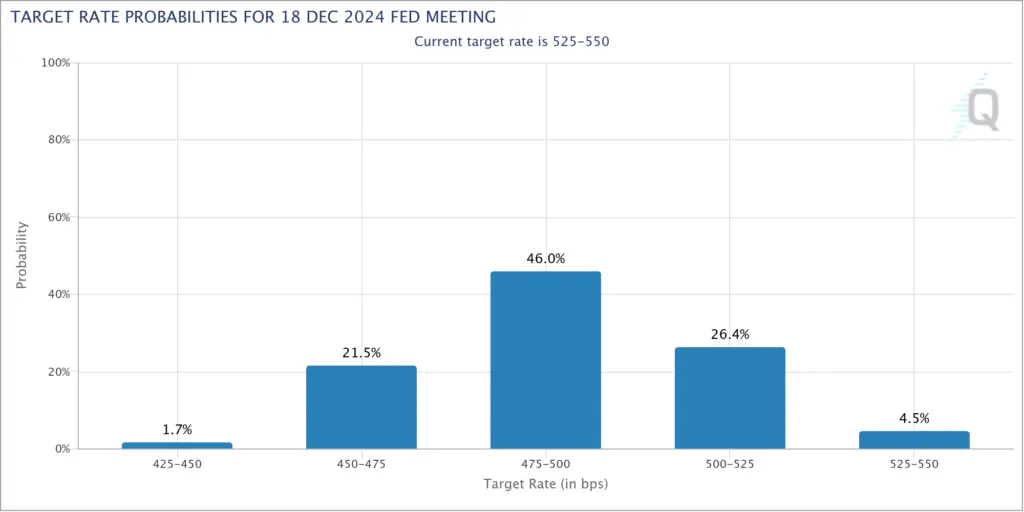

At the start of 2024, the market priced in six rate cuts for the year. But with the Consumer Price Index (CPI) still hovering above 3%, the Federal Reserve’s 2% target has been too far away to justify cutting the policy rate. While the CPI has shown virtually no progress on inflation over the last 12 months, the Fed’s preferred core Personal Consumption Expenditures (PCE) index, which strips out food and energy prices, has shown more promising signs.

Core PCE fell to 2.6% in May from a year ago, and just 0.08% from the previous month. That marks the smallest monthly increase since late-2020 and has raised hopes of a rate cut before the end of the year. At this point, Fed Fund futures are pricing in 1-2 rate cuts by year-end.

Despite US monetary policy remaining considerably more restrictive than the market had anticipated, the S&P 500 has continued to charge ahead. During the first half of 2024, the stock index closed at new all-time highs on 31 occasions and closed at 5460 by the end of June, far surpassing Wall Street’s even most bullish estimates going into the year.

A Productivity Boom

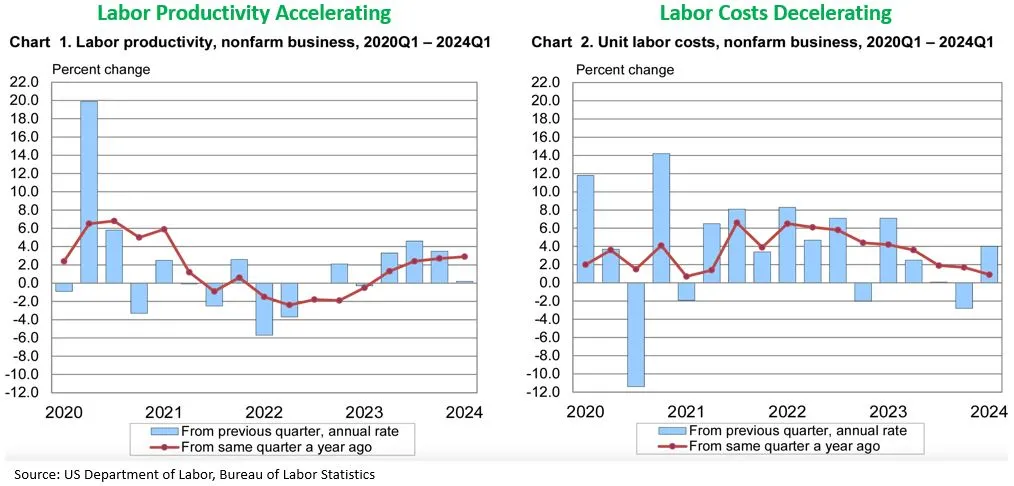

How could the S&P charge to such heights without the tailwind of expected monetary relief? One key factor is particularly rapid growth in labor productivity, the likes of which the US has not experienced since the early 1990s. For several consecutive quarters, US labor productivity has risen at an accelerating rate while labor costs have decelerated over the same period.

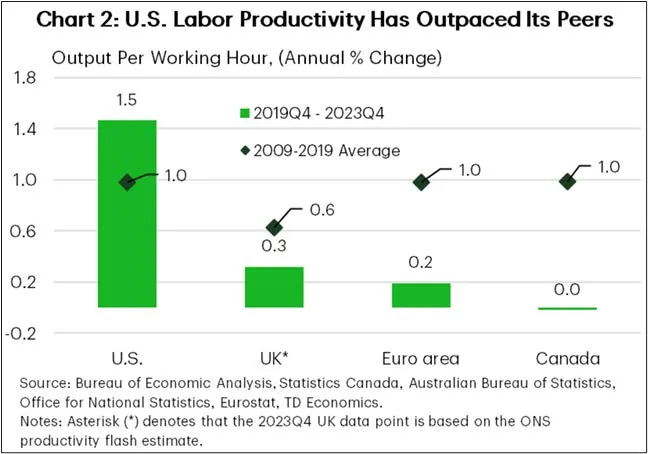

Add to that a prolonged period of historically strong employment and you have an especially potent mix that has been unique to the US. During the decade of 2009 to 2019, US labor productivity averaged 1.0%. Over the last four years, labor productivity has jumped to 1.5%. That is a vastly different picture than what is being experienced in other developed economies where labor productivity has fallen dramatically over the same period.

US Tech Dominance

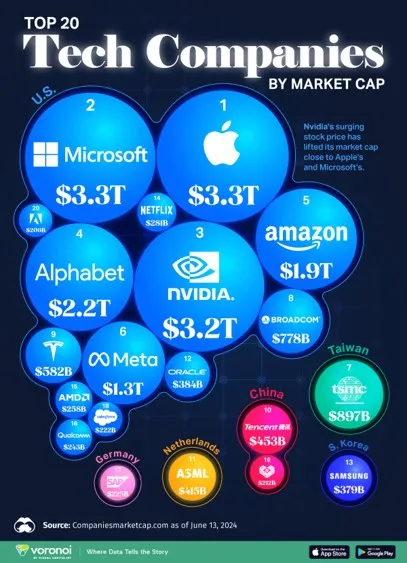

While it is too early to precisely pinpoint the reasons for enhanced US productivity, technology invariably plays a significant role. COVID-19 accelerated investment into technology that has boosted business efficiency. Even in October 2020, the World Economic Forum conducted a survey and found that 80% of companies planned to increase digitalization of their operations and 50% planned to accelerate the automation of production tasks. The US’s dominant presence in technology has enabled its economy to widen its lead over peers. Today, 14 of the 20 largest tech companies in the world are American, including the six largest.

McKinsey & Company published an article on “The Economic Potential of Generative AI,” and found that “generative AI could enable labor productivity growth of 0.1 to 0.6 percent annually through 2040” and “combining generative AI with all other technologies, work automation could add 0.5 to 3.4 percentage points annually to productivity growth.” It appears possible and even likely that some of those effects are already starting to occur within America’s largest companies.

Higher Earnings Expectations

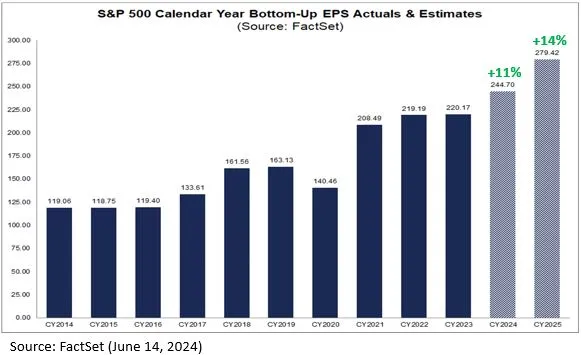

Those efficiencies are finding their way into corporate earnings projections. For Q2, S&P earnings are forecasted to increase 9% from a year ago and 11% for all of 2024. Analysts anticipate earnings will accelerate even further in 2025, expecting 14% growth next year.

Perhaps it’s no great surprise that the two sectors of the market expected to show the greatest earnings growth this year are Communications and Technology. Their profitability estimates have also been revised higher since last quarter.

Outstanding Short Interest

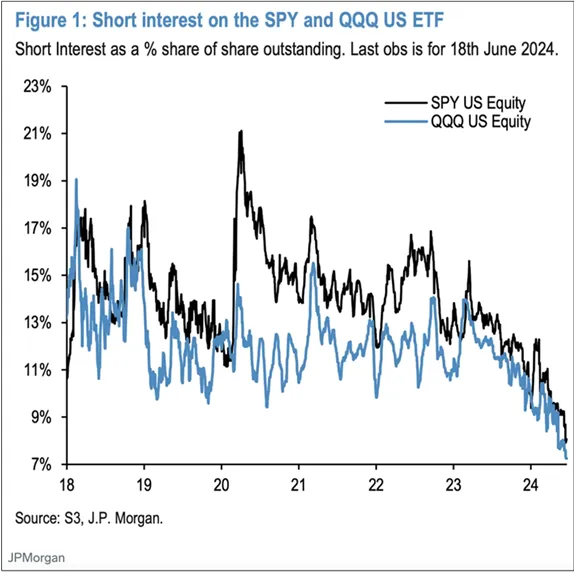

With the backdrop of burgeoning labor productivity, strong earnings, and the positive seasonality of an election year, short-sell interest has fallen to record lows. Furthermore, strong first halves in the stock market have usually boded well for the second halves of the year. Beanstox found that over the last three decades, when the S&P rose more than 10% in the first half of the year, it averaged a 12% return in the second half. These factors have discouraged short-selling for now but could spell trouble for the future when short-selling volumes revert back towards more normalized levels.

Loose Fiscal Policy Likely to Remain Prevalent

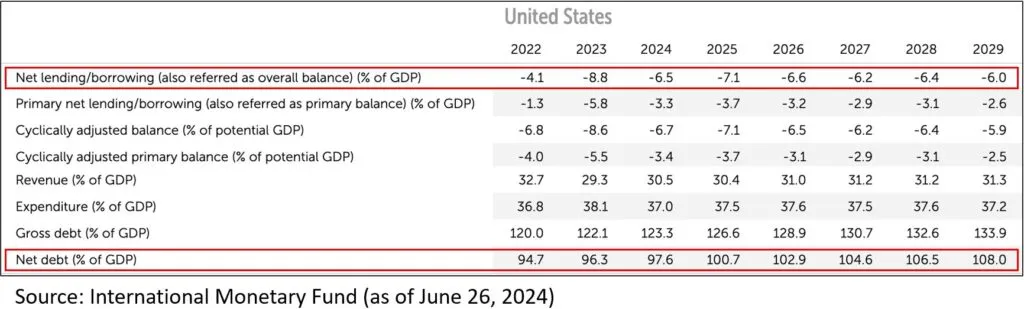

There will be considerable discussion regarding fiscal policy as the political discourse accelerates before voters head to the polls for this year’s general election. However, in the humble opinion of this author, fiscal policy is likely to remain loose regardless of the outcome. The IMF projects the US fiscal gap to run between 6 to 7 percent in the coming years. For context, the European Union’s EU Treaty requires members countries to keep their budget deficits within 3 percent of GDP. The IMF also anticipates US net debt will exceed its GDP starting next year, only to accelerate in the years thereafter.

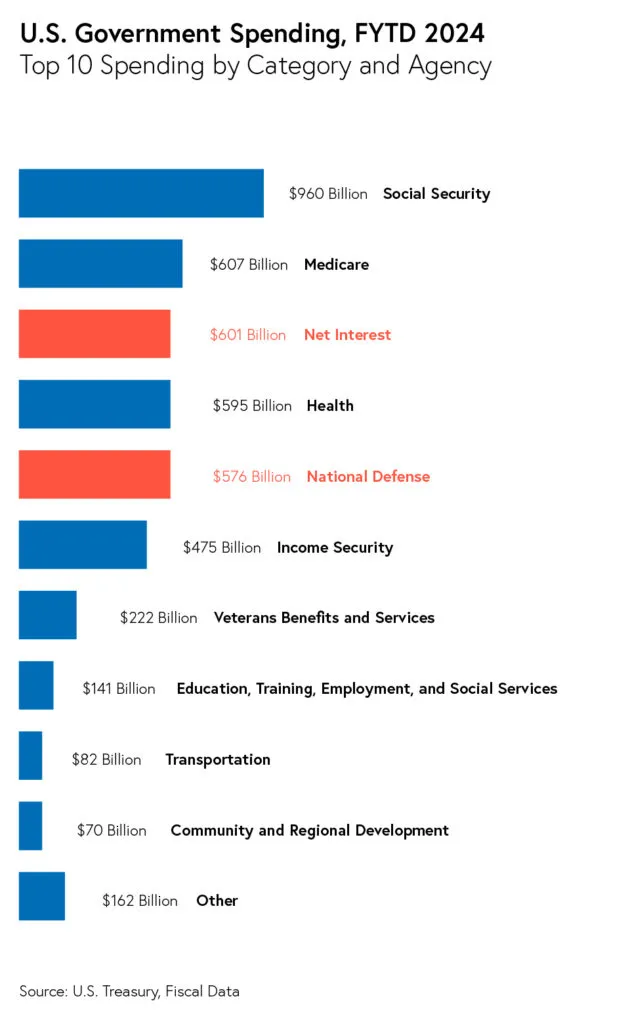

Looking at federal spending already this year, the large majority of the expenditures have been on mandatory programs such as Social Security, Medicare, Health, Income Security, and Veterans Benefits and Services. Net Interest, while not classified as a mandatory program, is also obligatory and now exceeds National Defense spending. Prominent Scottish historian, Niall Ferguson, drew attention to this fact in a tweet on X last month, remarking, “Any great power that spends more on debt service than on defense will not stay great for very long. True of Habsburg Spain, true of ancien[t] régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.”

Looking at federal spending already this year, the large majority of the expenditures have been on mandatory programs such as Social Security, Medicare, Health, Income Security, and Veterans Benefits and Services. Net Interest, while not classified as a mandatory program, is also obligatory and now exceeds National Defense spending. Prominent Scottish historian, Niall Ferguson, drew attention to this fact in a tweet on X last month, remarking, “Any great power that spends more on debt service than on defense will not stay great for very long. True of Habsburg Spain, true of ancien[t] régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.”

If this period of economic strength does indeed continue, the US needs to begin reforming its fiscal health while it’s in a relatively healthy position to do so. The good cards won’t last forever—it’s time to sit up straight and refocus. America will eventually need to be ready to play the bad hand that will one day come.