“Every moment of light and dark is a miracle”

– Walt Whitman.

2017 marked the first solar eclipse in the United States since 1979, perhaps a fitting spectacle given the stark contrast of light and dark moods that collided in our nation last year. On the one hand, optimism is at record levels – consumer confidence reached 17-year highs, business optimism is the highest on record, and the VIX (Volatility Index – aka the “Fear Index”) indicates investors are as sanguine as they’ve ever been. On the other hand, pessimism is also at record levels – the Hedonometer (Twitter’s Happiness Index) fell to an all-time low following October’s Las Vegas massacre, our President’s approval ratings reached record lows in December, and geopolitical tensions are the worst we’ve seen in decades.

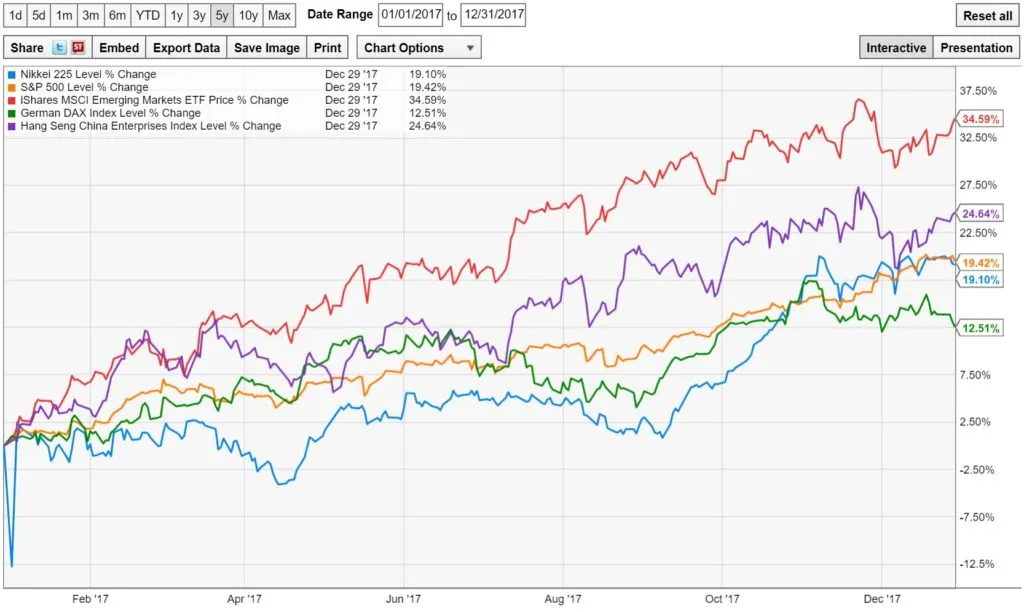

Nonetheless, as rare as solar eclipses come, an even more unlikely event occurred in the financial markets last year. It is true the S&P exceeded 20% for only the 6th time in the last 20 years, but what was most unusual about 2017 was the index did not experience a single down month. Remarkably, that is the first time that has happened in a dataset stretching back 90 years!

A number of very good things happened that made 2017 a special year for the markets:

Strong Corporate Earnings

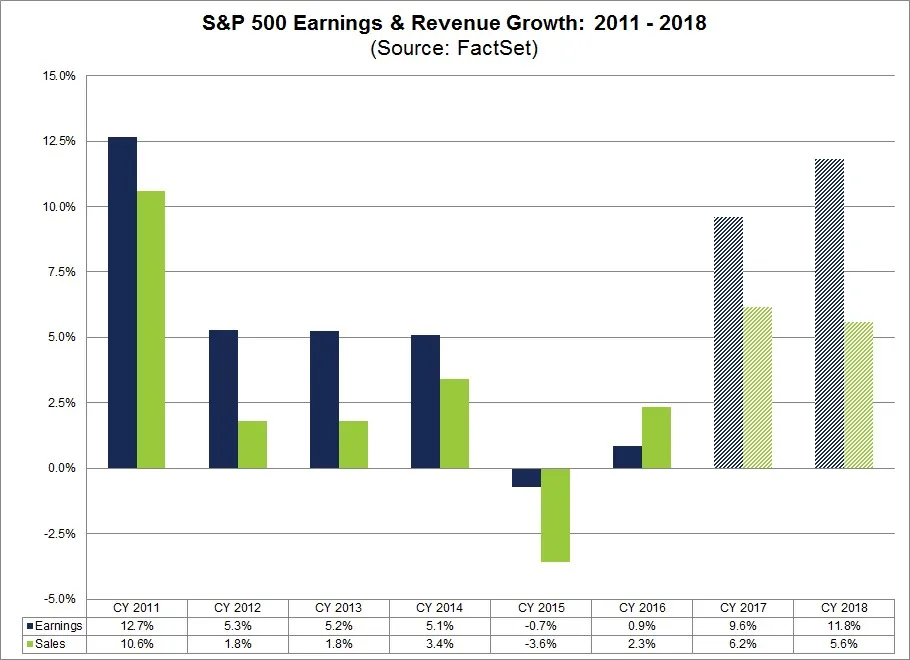

According to FactSet, S&P earnings last year likely grew 9.6% (best since 2011) and every one of the 11 major S&P 500 sectors experienced positive growth. That trend is expected to continue into 2018 with revenues estimated to grow 5.6% and earnings estimated to expand another 11.8%.

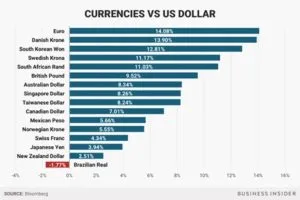

Weak US Dollar

In large part, the corporate earnings were supported by a weak US dollar (nearly half of S&P 500 companies’ earnings are generated overseas). 2017 was the weakest year for the dollar since 2003, weakening against nearly all of the world’s major currencies.

MAJOR GLOBAL MARKET RALLY

Through the 1st half of 2017, global developed markets were led by the German DAX. The 2nd half was led by the Japanese Nikkei. US markets benefitted and rallied steadily throughout the year. Further support came from emerging markets, which enjoyed their best gains in eight years.

Modest Inflation = Slow Rate Hikes

- Six predicted 3 hikes

- Six predicted 2 hikes or fewer

- Four predict 4 hikes or more

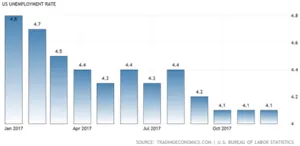

BEYOND FULL EMPLOYMENT

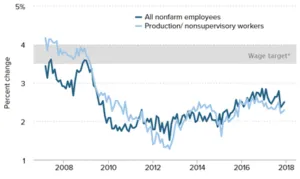

The US moved beyond full employment in 2017, with the unemployment rate falling to a 17-year low of 4.1% (full employment is generally perceived as ~5%).The employment statistic of greater interest to many investors, however, is wage growth; which has been stubbornly low. While Fed officials generally aim for 3.5% nominal wage growth (2% for inflation and 1.5% for productivity growth), actual wage growth in recent years has hovered closer to 2-2.5%; well short of the target. This has been a primary factor preventing the Fed from more rate increases and has pushed the market higher.

The US moved beyond full employment in 2017, with the unemployment rate falling to a 17-year low of 4.1% (full employment is generally perceived as ~5%).The employment statistic of greater interest to many investors, however, is wage growth; which has been stubbornly low. While Fed officials generally aim for 3.5% nominal wage growth (2% for inflation and 1.5% for productivity growth), actual wage growth in recent years has hovered closer to 2-2.5%; well short of the target. This has been a primary factor preventing the Fed from more rate increases and has pushed the market higher.

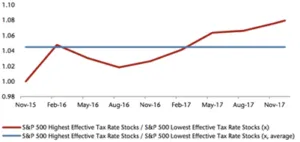

HISTORIC TAX REFORM

It is important not to underestimate the significance of the recent tax cut, which is historic. A 21% corporate tax rate is the lowest in the United States since 1940. Markets are reacting extremely positively to the policy change because 1) the public did not anticipate a deal could be worked out so quickly and 2) the rate reduction was larger than expected. While the overall market performed well last year, it is evident that companies paying the highest effective tax rates are experiencing outsized gains as they stand to benefit the most from the cuts. Two sectors of particular interest are banks (they pay especially high effective tax rates) and technology companies (they enjoy a repatriation tax holiday and 60% of tech company revenues are generated overseas).

2018 OUTLOOK

What does this mean for 2018? The fundamentals remain strong – expansion in corporate earnings, strong labor data, low inflation, and lower taxes all point to a market that should continue to go higher. Nevertheless, while we will remain well-invested in the market we have reduced a bit of risk as we see other worrying technical signs of a potential looming correction.

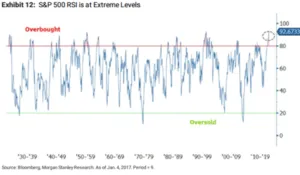

An overbought market – the RSI (Relative Strength Index) has reached extreme levels and is the highest it’s been in 20 years. This can be somewhat explained by historically low yields, but we know yields are only going up and it’s simply a matter of how quickly. An RSI above 80 rarely occurs and consistently precedes a correction.

A flattening yield curve – a healthy yield curve is upward sloping but in recent months the curve has been shifting the other direction. An inverted yield curve is dangerous because when short-term rates exceed long-term rates, bank loans generate less income than bank deposits and therefore lending is halted and the money supply disappears. An inverted yield curve has correctly predicted the last seven recessions going back to the 1960s. While the current yield curve still remains slightly upward sloping, the rise in 2-year yields and drop in 30-year yields is concerning and we are watching the shape of the curve very carefully.

A SOCIAL ECLIPSE

While last August’s solar eclipse offered only minutes of totality, we continue to face a collision of extreme optimism and pessimism in this country that feels akin to a ‘social eclipse’ of sorts. At the start of this letter I quoted Walt Whitman, “Every moment of light and dark is a miracle.” An interesting phenomenon happens during an eclipse – the sun and moon being on the same side of the earth causes a gravitational “tidal” force that causes a body tide in the solid rock of Earth, raising the earth’s crust and surface by about 40 millimeters.

I am hopeful that this unique ‘social eclipse’ we are experiencing will similarly elevate us as a community and bring out the best in each of us individually. We are grateful for the opportunity to work closely with you and serve you. On behalf Ted Ong, Elisa Williamson, Jared Ong and myself, may you have a Happy 2018 and a Lucky Year of the Dog!

The above information is for informational purposes only and should not be used as a substitute for individual investment advice. Past performance does not guarantee future results. There is no guarantee that any investment strategy will generate a profit or prevent a loss.