There are two ways to be happy: improve you reality, or lower your expectations.

– Jodi Picoult

Overview

This year, S&P 500 companies suffered an earnings decline for the first time since 2016 and major economies around the world are showing signs of slowing. These are hardly factors one might expect after US stocks just posted their best first half since 1997. But the 0.4% earnings decline in Q1 was considerably better than the 3.9% decline that was expected, and Q1 GDP growth of 3.2% blew away the 1% that was modestly forecasted. While low expectations have helped bring the market to all-time highs in recent days, our actual reality will need to show fundamental improvement to sustain this latest rally.

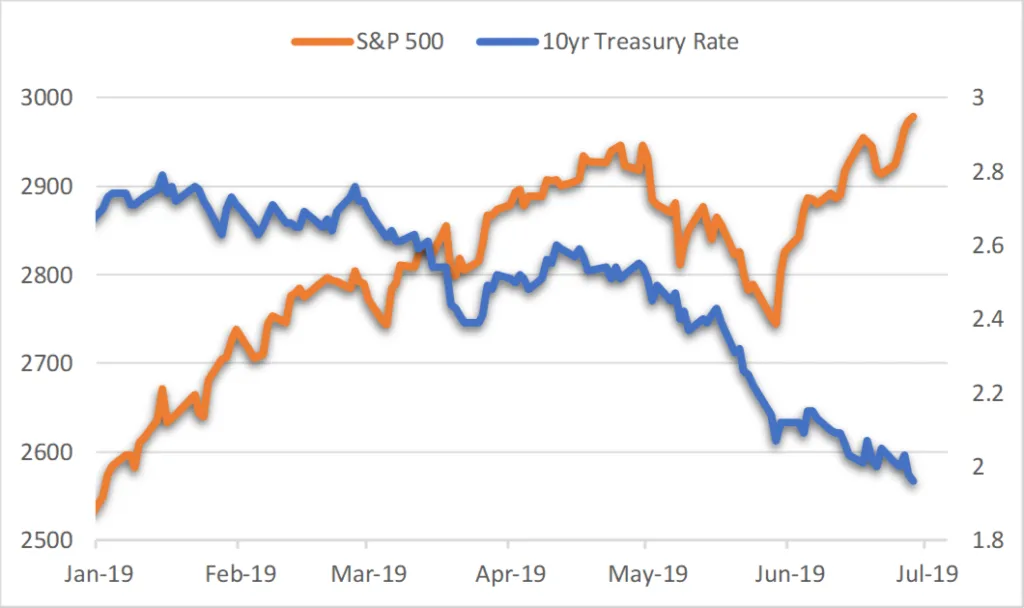

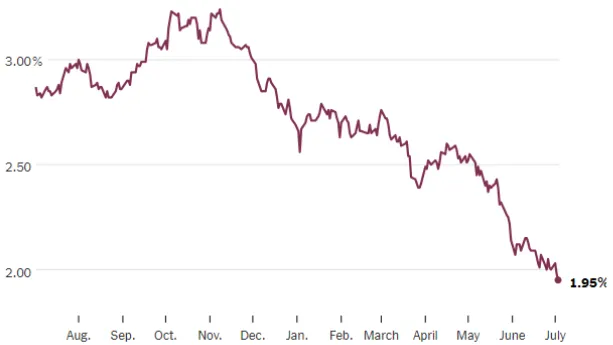

With growing concerns over slowing expansion, trade tariffs, and geopolitical rivalries, bond yields have compressed down to their lowest levels since late-2016. The flight to safety and rally in bonds is clearly evident through changes in global asset allocations. For instance, in June, gold-backed ETFs saw their biggest inflows in seven years. Additionally, taxable corporate and government bonds had an 11.5% increase in flows in the first half of the year and municipal bonds saw a 9% increase over the same period. By contrast, US funds suffered huge equity outflows during the 2Q, particularly in late May. These changes as well as a change in tone from the Federal Reserve have brought interest rates significantly lower, which has been supportive of stock valuations. Expectations are already low, now we need to improve our reality.

Low Expectations

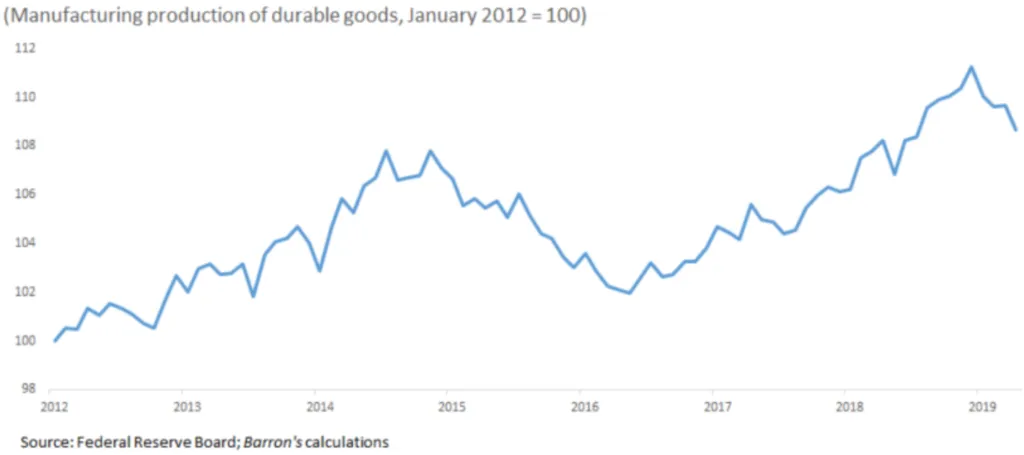

There is significant evidence of economic slowing both within the US and abroad. Even looking at the 3.2% GDP growth seen in Q1, the headline figure was largely attributed to exceptional inventory accumulation in anticipation of trade tariffs as well as reduced spending on imports. Stripping out the effect of inventories and trade brings the annual growth rate down to 1.5%, which is in line with the Atlanta Federal Reserve after they cut their 2Q forecast last week on an unexpected 0.8% drop in May construction spending. Overall industrial output has also dropped since December. Production of nondurable goods is down 2.3% and durable goods such as vehicles, machinery, and equipment is down 5%.

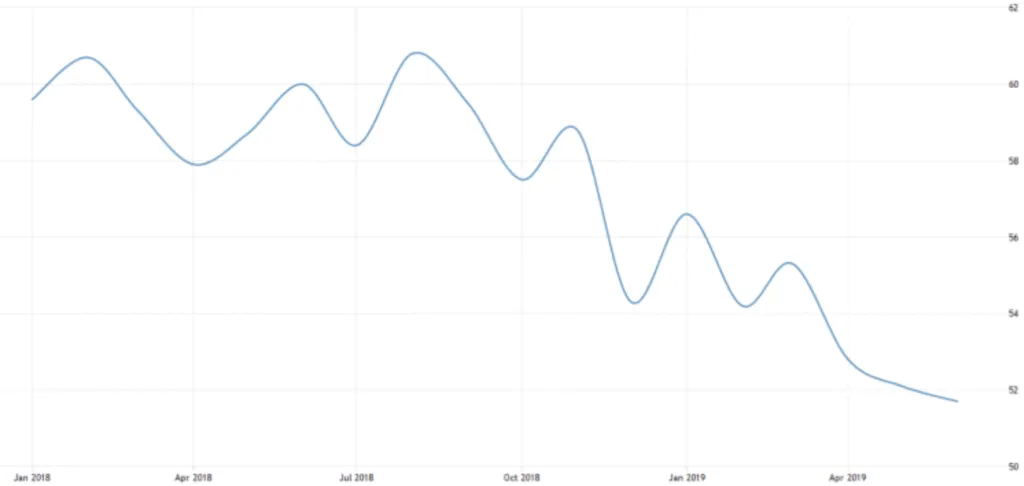

Furthermore, the ISM Purchasing Managers Index (PMI), a measure of business conditions for company decision makers and a leading indicator of economic activity in the US has steadily declined since the middle of last year. While a reading above 50 represents an expansion from the previous month, the downward trend over the last 12 months is clearly evident.

Pessimistic 2Q Earnings Outlook

No surprise the broad slowdown is expected to seep into corporate earnings in the 2nd quarter. S&P 500 companies are expected to report a 2.6% earnings decline for the last three months. If earnings do indeed fall back it would mark the first consecutive-quarter profit reduction since Q1 and Q2 2016. Guidance has been generally negative thus far with 88 S&P 500 companies already issuing negative EPS guidance versus only 26 positive.

To Deal, or Not to Deal? That is the Tariff

With stocks up 18% by the end of April, investors viewed a trade deal with China as largely a foregone conclusion. That perception was quickly dashed in early May, however, when trade negotiations broke down and the US increased tariffs on $200 billion of Chinese goods from 10% to 25%. China responded in-kind by raising tariffs on $60 billion of US goods in early June. While the tone of the discussions has since de-escalated over the G20, the certainty and timing around a possible trade deal remains unclear; a very different proposition than what was being discussed three months ago.

A Deafening Omission from the Federal Reserve

“Patient.” This was the word conspicuously omitted from the Fed statement in June. After four rate hikes in 2018 as the economy started to slow the central bank emphasized the need to be “patient” towards future interest rate increases. The glaring omission of the word “patient” in the latest round was a strong admission from the Fed that not only are hikes no longer on the table but a future cut is more likely. In fact, most market participants expect a July cut with at least one more later this year. Even before the Fed’s June policy statement, the bond market was already well-ahead of the change in rhetoric and had priced in lower rates for several months.

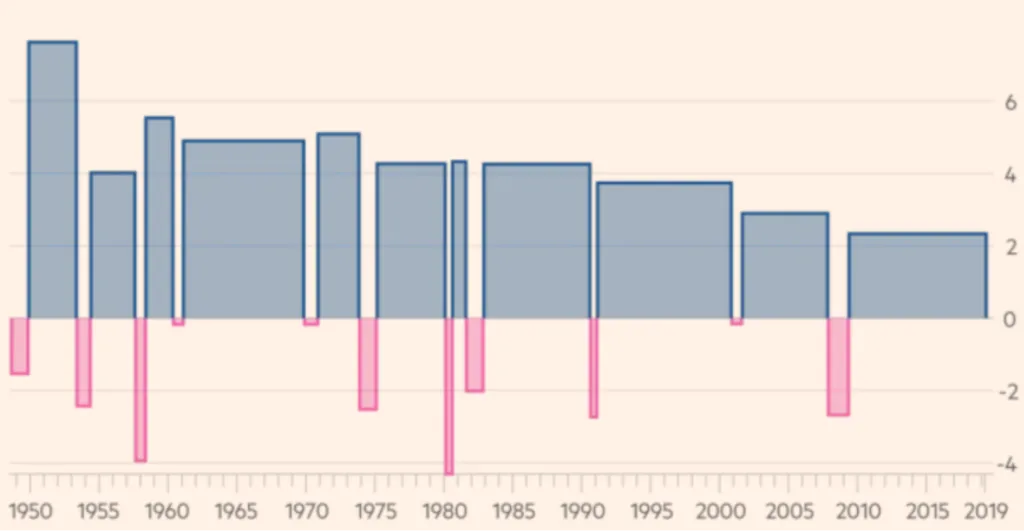

The Longest Recovery ≠ The Strongest Recovery

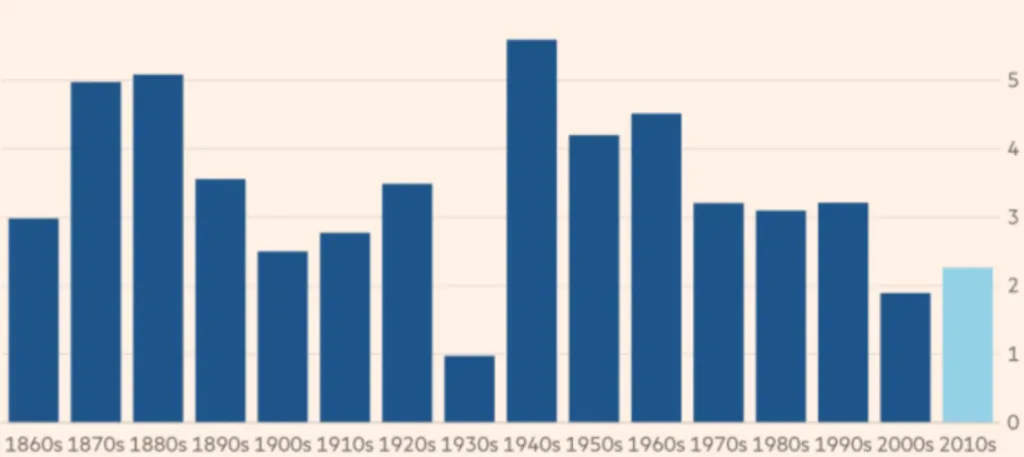

This past week the current economic recovery reached a historical milestone; notching 121 consecutive months of expansion and making it the longest stretch of growth in American history. While the streak is indeed impressive, this recovery also has the less flattering distinction of being the weakest recovery since World War II. Over the past decade the US economy has experienced cumulative growth of just 25% (2.3% annually), which is well below the 38% growth seen in the Reagan-era of the 1980s and the 43% growth seen in the Clinton-era of the 1990s.

Thus it may come as a surprise that although this decade has enjoyed an uninterrupted period of expansion, the 2010s has had the lowest growth apart from the recession-hit 1930s and 2000s, which may suggest the economy is not as overheated as some might expect.

While the economy has slowed down recently, the shift in global asset allocations and large reduction in interest rates reflects low expectations baked into certain areas of the market. What investors may not be positioned for, is if we see improvements in economic data arising from more accommodative monetary policy or an eventual trade deal with China. For now this is not yet a reality, but it is a possibility.