All of us, at some time or other, need help. Whether we’re giving or receiving help, each one of us has something valuable to bring to the world. That’s one of the things that connects us as neighbors—in our own way, each one of us is a giver and a receiver.

– Fred Rogers

An Unprecedented Shock

Until the impact of Covid-19, the US economy was on strong footing. Unemployment edged down to a 50-year low of 3.5% and even as recent as February showed significant job growth. Last year the economy was on a good trajectory—growing 2.3% with a total output of $21.4 trillion. This viral pandemic marked an abrupt end to the longest economic expansion in US history, which spanned 129 months from June 2009 until February 2020. Over the period, the US economy grew 44%.

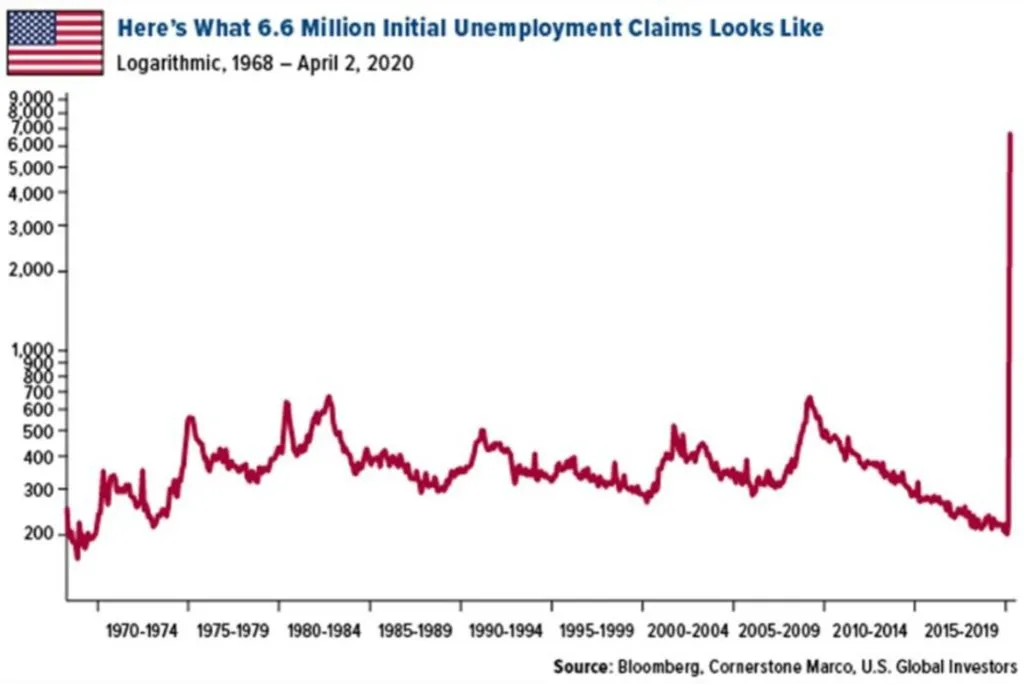

The last two weeks have painted a grim picture. The shutdown has caused 10 million Americans to already file for jobless claims and total job cuts resulting from Covid-19 could soon exceed those of the Great Recession (~15 million jobs were lost from 2007-2009). While we await the April jobs report, many expect the unemployment rate has already exceeded 10%.

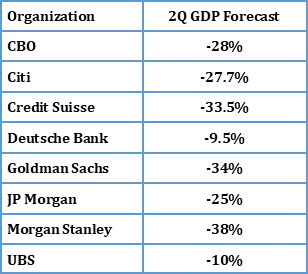

What is especially troubling, is the widespread nature of this economic shutdown. Past recessions have been driven by stresses in specific areas of the economy—such as banks and real estate in the Great Recession, technology in the Dot Com Bust, commercial real estate in the Savings & Loan Crisis, and oil and gas in the Energy Crisis of the late 70’s. Covid-19 has closed the entire economy full stop and the magnitude of the economic toll is difficult to gauge. Estimates of the contraction in economic activity are wide-ranging and fast-moving. For instance, JP Morgan initially forecasted on March 18 the economy could sink 14% in Q2 only to revise the estimate to 24% only ten days later. Goldman Sachs initially forecasted a 24% decline on March 20 and adjusted their estimate to 34% on March 31. Last week the CBO (Congressional Budget Office) forecasted a decline of 28% for the upcoming quarter.

It appears the US may suffer its largest ever quarterly decline (vs –10% in Q1 1958). Beyond this quarter, most analysts are looking for the economy to partially rebound in the second half of the year but do not expect a full recovery until a vaccine becomes widely available.

The Fastest Bear

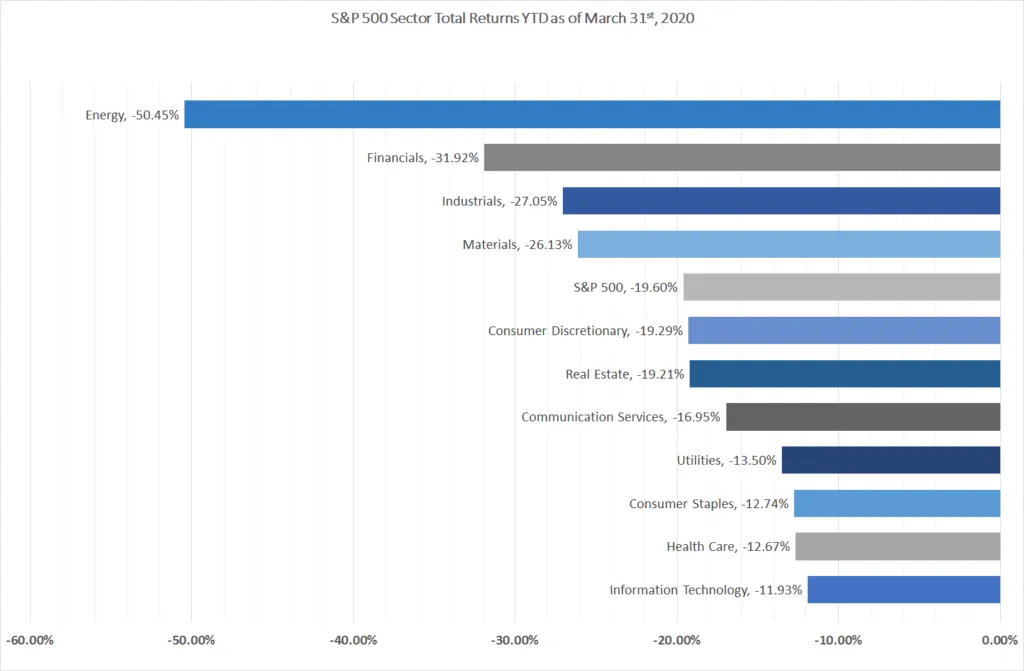

Covid-19 took the S&P 500 down from record highs on February 19 into a bear market within just 20 trading days, the fastest bearish drawdown in US stock market history (20% declines in the past took 255 sessions on average). For comparison, even the Great Crash of 1929 took 36 sessions to drop into bear market territory. Last month, apart from Black Monday of 1987, the S&P 500 witnessed its two worst trading sessions since 1929; dropping 12% on March 16 and 9.5% on March 12. All of the 11 major sectors took a hit last quarter, with energy and financial stocks hit particularly hard. Industries that held up relatively better included technology, health care, consumer staples, and utilities.

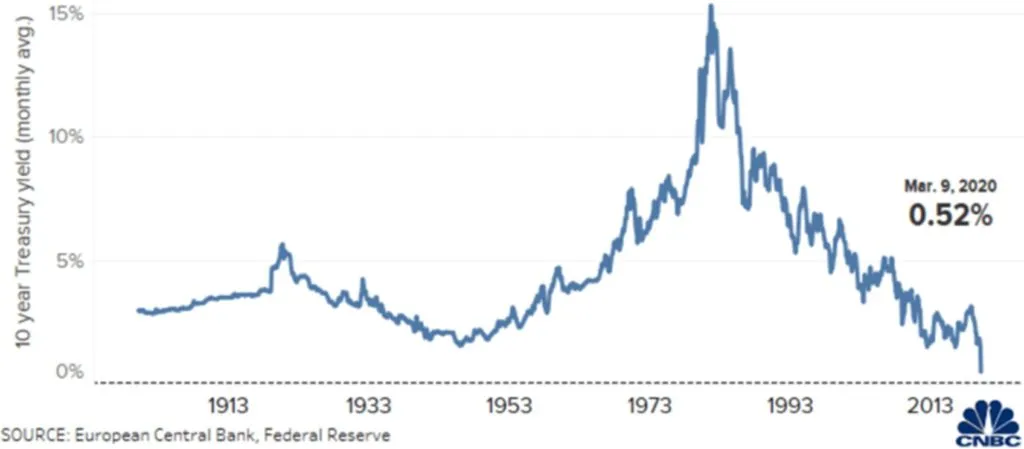

A failed OPEC deal on March 6 prompted a 26% crash in energy prices the following session, the worst day for the sector since 1991. Bank stocks were crushed (despite significant improvements in capitalization) on liquidity and funding concerns in the monetary system as well as two rapid rate cuts that brought the Fed’s target rate from 1.5% to zero in short order and 10-year treasury yields to an all-time low on March 9.

Time to Reach for the Toolkit

After its experience from the Great Recession of 2008, the Fed added new tricks to its policy toolkit in managing monetary crises. This time, the Fed acted both faster and more dramatically to the Covid-19 pandemic than 12 years ago. While the Fed’s decisions to make emergency rate cuts of 0.50% on March 3 and 1.00% on March 15 received the bulk of the attention, they have taken numerous other measures to try to restore order to the US monetary system. Fed Chief Jerome Powell has declared, “We really are going to use our tools to do what we need to do here.” Actions so far include:

- Market intervention through purchase of US Treasuries, agency mortgage-backed securities, and IG corporate debt.

- Establishment of an Exchange Stabilization Fund (ESF) to support the flow of credit to businesses

- Two credit facilities for large employers in the public markets (Primary Market Corporate Credit Facility and Secondary Market Corporate Credit Facility)

- Term Asset-Backed Securities Loan Facility

- Money Market Mutual Fund Liquidity Facility

- Commercial Paper Funding Facility

An Ambitious Push for Stimulus

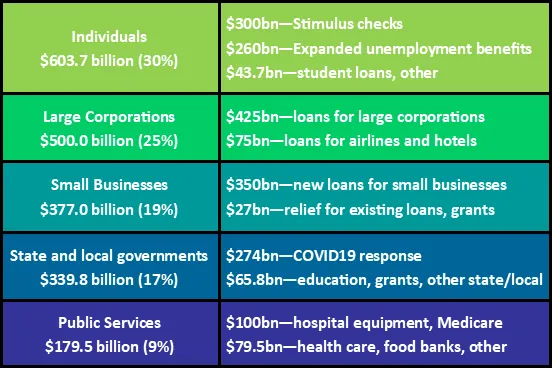

Alongside with the Fed’s drastic monetary actions, the government also passed a massive $2 trillion stimulus package as part of the CARES Act (Coronavirus Aid, Relief, and Economic Security) on March 27. This stimulus package dwarfs the ARRA (American Recovery and Reinvestment Act) of 2009 that totaled around $830 billion and the Economic Stimulus Act of 2008 that cost $152 billion. The largest portion of the money is slated to go to most households and unemployed workers. Significant sums will also go to large distressed corporations and small businesses. Additional money has been set aside for Covid-19 response, schools, hospitals, health care, and foodbanks.

Peering Beyond the Bell

With Covid-19 spreading on a bell-shaped curve, many models are hopeful that the US will finally see the rate of new cases and mortalities begin to slow this month. The economy has suffered tremendously during this period (as has been discussed at great length here), but even greater than the economic suffering is the human suffering that has been endured in recent weeks and months. Our hearts and thoughts are with individuals and families coping with this virus. This Good Friday our team will join with thousands of other people of faith in a Worldwide Fast for 1) the pandemic to be controlled, 2) caregivers to be protected, 3) the economy to be strengthened, and 4) life to be normalized. Please everyone stay safe, stay strong, and Godspeed.