“The way I see it, if you want the rainbow, you gotta put up with the rain.”

– Dolly Parton

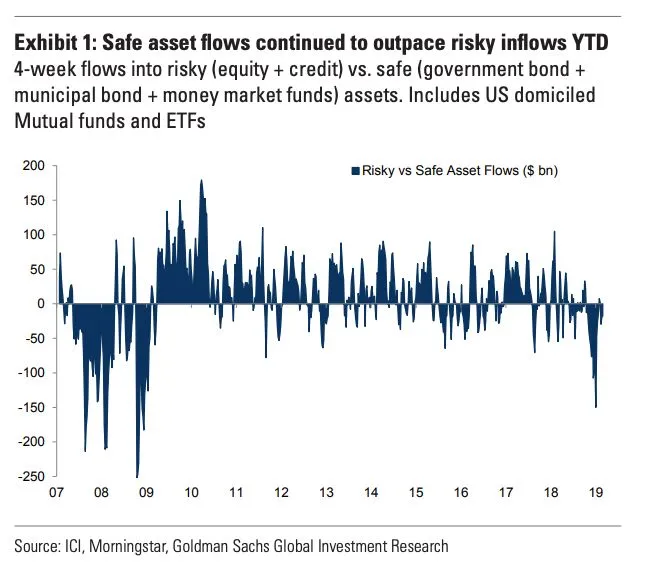

After a torrential storm in the market last quarter, many investors packed up their things and went back in their houses. According to Morningstar data, US-based funds and ETFs saw ~$80 billion of outflows in the 4Q of 2018 and another $28 billion of outflows through early March of this year, the biggest outflows since the Great Recession. As is the case with rainstorms, however, they are followed by a majestic rainbow. In this case last quarter’s storm was followed by the best three months for the market in a decade, which left many investors wishing they had been back outside to enjoy the beautiful sight.

The other thing about rainbows, however, is they tend to be short-lived. Markets recovered from last year’s losses because the major causes for concern in late 2018 have been largely de-escalated for now. The previously over-aggressive Federal Reserve (Fed) that we feared could recklessly hike interest rates into a slowing economy has since stepped back, and at this point the market does not expect any further rate increases this year. Furthermore, fears of a trade war between the US and China now look less disconcerting as both countries have signaled substantial progress in their trade negotiations. While these issues appear less menacing than a few months ago, there are concerns that continue to persist. Global growth has continued to slow down and bond yields have shown some potentially worrying signs.

A MARKED CHANGE OF TONE FROM THE FED

Last quarter we cited the Fed’s impact on the market selloff. Particularly a comment from Chairman Jay Powell last October that interest rates were “a long way from neutral” prompted the worst selloff in years and set the table for the worst December since 1931. That all changed on January 3 this year, when at the American Economic Association meeting in Atlanta he said the Fed is willing to be “patient” and even conceded that the reserve bank could reassess its program to reduce the balance sheet through quantitative tapering if needed.

While stocks have recouped nearly all of the previous quarter’s losses, for now the Fed has not deviated from its commitment to remain patient; which has contributed to interest rates hovering near 12-month lows. For now there does not appear to be a pressing need to change its stance as domestic inflation has generally remained below the Fed’s 2% inflation target. While inflation has gradually trended higher over the past five years, the US has been unable to stay above the 2% target for a sustained period.

PROGRESS ON US-CHINA TRADE BUT QUESTIONS REMAIN

Both the US and China have expressed optimism about current trade talks. US Trade Representative Robert Lighthizer has said, “We’re certainly making more progress than we would have thought when we started.” So far China has already made some concessions to meet US demands, such as committing to large purchases of US agricultural products and reducing tariffs on US car imports. In early December, China also announced 38 penalties against intellectual property violations, and in March passed a new foreign investment law intended to level the playing field for overseas investors that will take effect on January 1, 2020 (details of the new law are scant at this point).

Nevertheless there remain issues that are still unsettled; such as Chinese government subsidies to domestic companies giving them unfair advantage over foreign peers operating in China, forced technology transfer requiring foreign companies to reveal their intellectual property in order to operate in China, and how China will manage its currency going forward.

Even if and when these matters are settled, perhaps the more overarching issue belying the discussions is how such a trade deal would be enforced. The two sides are debating at what pace the US would remove tariffs once a deal is struck. Beijing would like all $250 billion of tariffs removed immediately while Washington DC would prefer to do it gradually and only as China lives up to its end of the bargain, given its weak track record of living up to its word.

While a summit meeting has not yet been announced, the general consensus is that a summit will not be scheduled unless the two sides have an agreement in place. But while the US and China continue to draw closer to a deal, the US has pivoted to raise additional trade concerns with a different party.

ECONOMY IS SLOWING BUT IMMINENT RECESSION SEEMS UNLIKELY

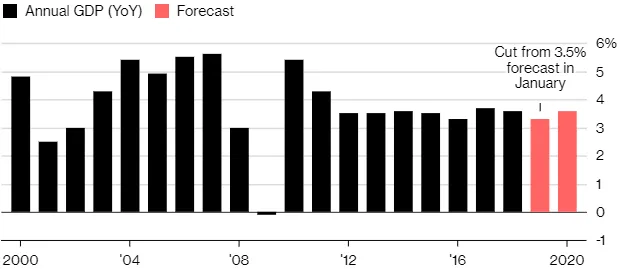

From December 22, 2018 to January 25, 2019, the US government was shut down for 35 days, the country’s longest government shutdown in history. The Congressional Budget Office (CBO) estimates that the shutdown cost the US economy $11 billion and lowered Q4 2018 GDP growth by 0.4 percentage points and Q1 2019 GDP growth by 0.2 percentage points. Last quarter the US economy grew 2.2% and this quarter is expected to expand ~1.5%. While these figures are considerably lower than the growth posted in recent quarters, many analysts expect activity to pick up again in Q2 and anticipate growth to average above 2% for the full year; which would be slightly above the average US growth rate over the past two decades.

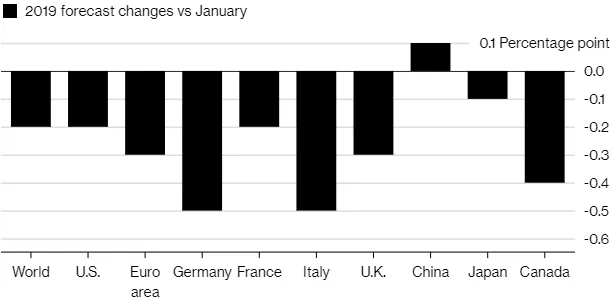

Global growth, however, is slowing considerably. The International Monetary Fund (IMF) downgraded its outlook three times in the last six months, most recently cutting its 2019 global growth forecast to 3.3% (from 3.5%). This would mark the lowest growth rate since 2009, when the world economy declined amidst the Great Recession.

Europe, in particular, is expected to see slow expansion. The IMF cut its growth forecast for the euro area to 1.3% for 2019, with Germany and Italy seeing the largest reductions in their countries’ outlooks. Of the major national economies, only China saw a higher forecast since January; supported by the country’s growing stimulus program. China is expected to expand 6.3% this year. India is expected to grow 7.3%, down from 7.5% in January.

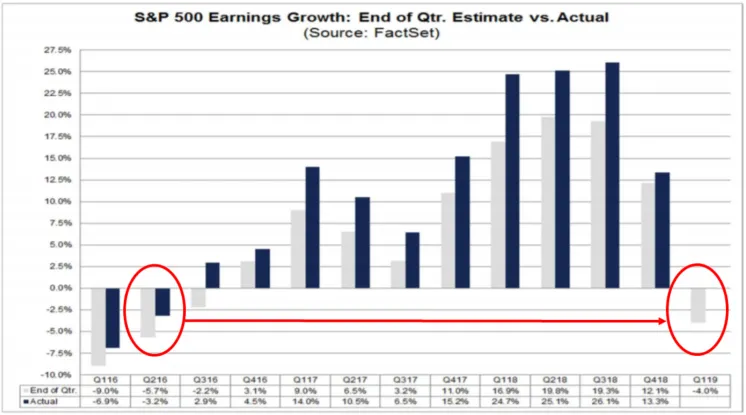

EXPECT SOFTNESS IN 1Q EARNINGS

As we approach earnings season, analysts expect a profit decline for the S&P 500 of –4.2%, which if realized would mark the first year-over-year reduction in earnings since 2Q 2016. Unsurprisingly, more companies issued negative earnings- per-share (EPS) guidance than positive; 79 to 28, respectively.

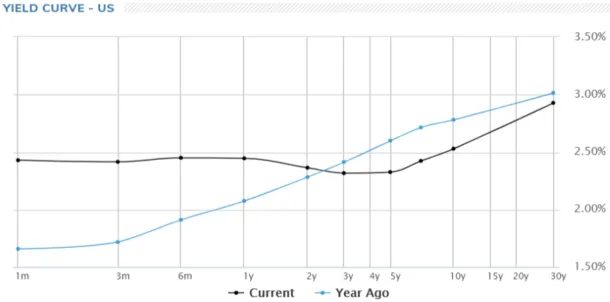

A FLATTER YIELD CURVE

Over the last 12 months, the yield curve further flattened and inverted slightly between the 2yr and 5yr points of the curve. A traditional inverted yield curve occurs between the 2yr and 10yr points.

APPROACH THE REST OF THE YEAR CAUTIOUSLY

A 10%+ down quarter followed by a 5%+ up quarter like we just experienced has often been a positive signal for the subsequent nine months. This type of market action has occurred on 11 occasions since 1970, and with the exception of 1987 (when Black Monday occurred), the market has experienced positive gains in every instance.

Nevertheless, if this earnings season does indeed come in soft as expected and the global economy continues to slow further, investors should remain cautious in the coming months. The yield curve remains unsupportive of growth, there continues to be uncertainty around global trade against a market that expects an auspicious outcome, and stock valuations are at best fair. Let’s enjoy the rainbow for now but keep your umbrella close for the next storm.