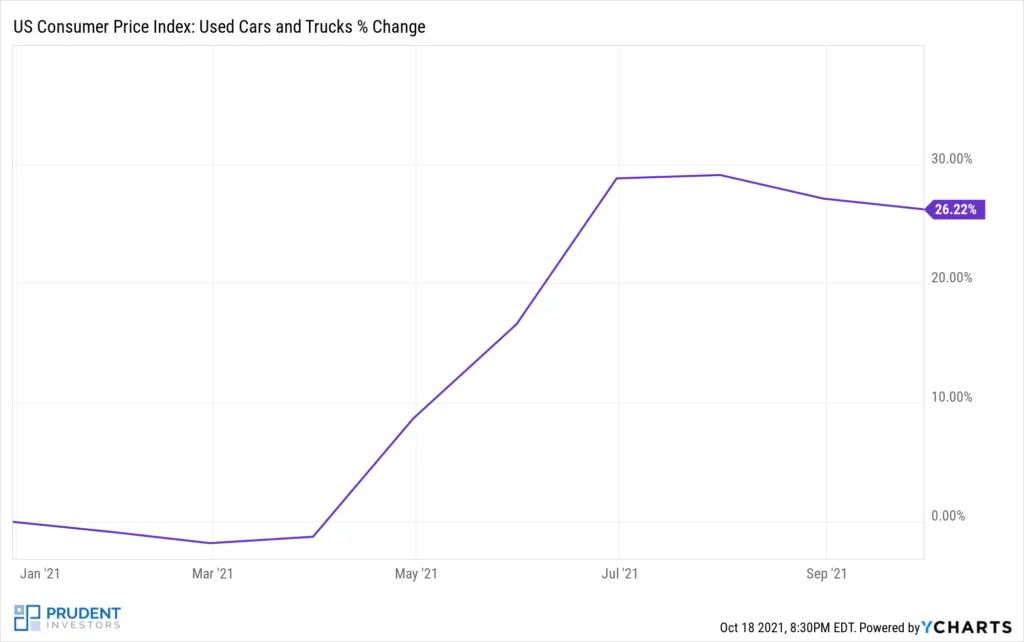

If you’re like me, shopping post-Covid has resulted in some serious sticker shock. In May, strawberry prices were up almost 27% because Driscoll’s under-estimated demand and told farmers to plant different fruit. Used car prices are up over 26% because of lack of supply.

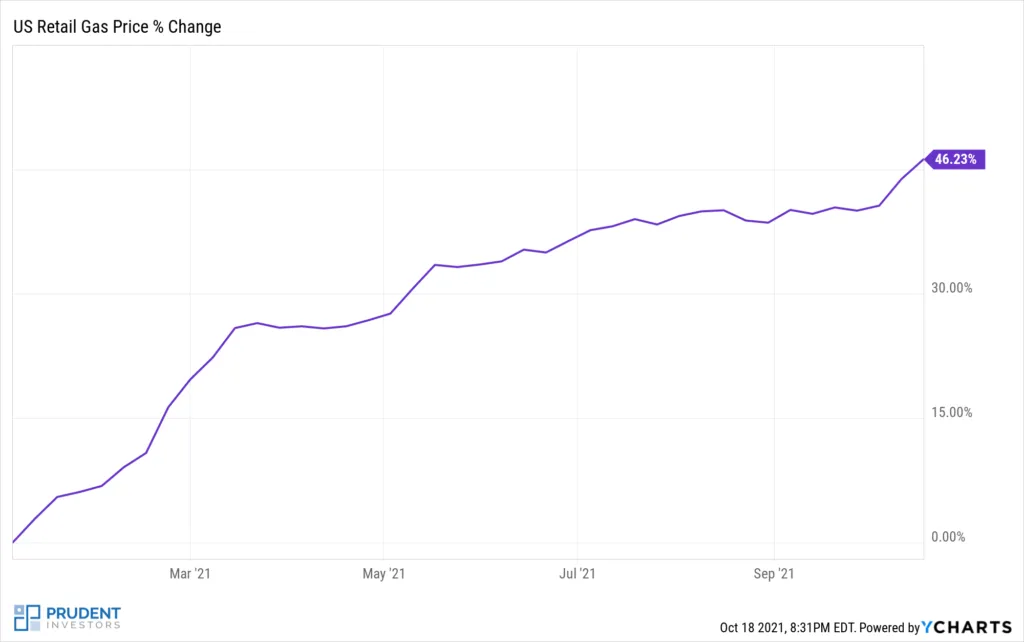

And at the pump, gasoline prices have surged over 40% since the beginning of the year. Inflation is on everyone’s mind.

Inflation isn’t a bad thing, it’s actually a sign of a healthy, growing economy. But due to pandemic related supply chain issues and labor shortages, prices are increasing faster than expected.

So how do we use inflation to our advantage? Here are three tips on how to take advantage of inflation that can help you prosper during an inflationary environment and make inflation work for you.

How to Take Advantage of Inflation

Borrow Money at Fixed Rates

Borrowing money at fixed rates is a great way to take advantage of inflation. Here’s why: when prices rise too quickly, the Fed normally raises interest rates to prevent runaway inflation. This increase in rates decreases your overall purchasing power. But by having a fixed-rate loan, such as a car loan or mortgage, you’re able to pass along this decrease in purchasing power to someone else. In essence, you are paying the loan company back with dollars that are worth less. By borrowing money at fixed rates, you’re able to place some of the impact of inflation on the person or company lending you the money.

Fixed-loan payments also have another advantage through the certainty of fixed costs. This is especially helpful during times of high inflation, when wages and revenues tend to rise. An added bonus is your fixed-loan payments end up being a smaller portion of your salary.

Currently, interest rates are at all time lows, but they’re unlikely to remain this way forever. Locking in a fixed low rate now will allow you to be prepared for the eventuality of higher rates.

When looking for loans, be wary of products that allow you to borrow money at variable rates, such as credit cards, adjustable rate mortgages (ARMs) or home equity lines of credit (HELOCs). This can put you at risk of higher interest payments when interest rates rise.

Consider Investing in Real Estate

Real estate can be a great way to offset inflation’s impact. This is because real estate is a hard asset, and hard asset values generally increase with inflation. Real estate can also be purchased using a fixed rate loan which has the benefits noted above. Even more advantageous are investments in property that generate income, such as rental properties or commercial real estate. These investments are great for an inflationary environment because you have the ability to raise rents in response to inflationary market forces such as an increase in wages. Coupled with your fixed mortgage costs, you can end up accruing wealth faster.

Stay Invested in the Stock Market for the Long Term

A decrease in purchasing power may seem scary. But when inflation is compared against the historical growth of the stock market, it’s clear that remaining invested in equities over time will increase your purchase power faster than inflation. If you can afford to stay invested instead of spending your money on depreciating assets or consumables, your money will be worth a lot more because of a higher compounding effect.

In 1986, for example, it cost $1.60 to buy a Big Mac. In 2021, a Big Mac costs $5.65. This means that the same $1.60 from 1986 would only buy you 26% of a Big Mac in 2021. If that $1.60 was invested in the stock market for the same time period, it would have grown to $62.71. That’s enough to buy more than 11 hamburgers at 2021 prices. Thus the way to reduce the impact of inflation is to invest your money and avoid spending it on a consumable that, because of inflation, becomes more expensive.

For those concerned about investing in equities during an inflationary environment, it may be helpful to consider value-oriented stocks. In general, research has shown that value stocks are less affected by inflation than growth stocks. This is because value companies are firmly established and have stable cash flows. On the contrary, growth stocks are priced based on future expectations for growth. When interest rates rise, these projected future earnings end up being worth less and have to be discounted against higher interest rates. Regardless of whether you believe in the potential of growth stocks or value stocks, it’s important to stay invested and let the market work for you.

Ultimately, high levels of inflation will end up being transitory. In the meantime, the above tips will hopefully provide some ideas and opportunities on how to take advantage of inflation.

If you have questions on your own personal finance or additional ways to build wealth, contact us at any time to learn about how we help individuals and households achieve financial success.