Even an empire cannot control the long-term effect of its policies. That is the essence of blowback.

Chalmers Johnson

Vibecession

In the summer of 2022, a young financial content creator, Kyla Scanlon, coined the term, “Vibecession,” to describe the souring mood prevailing over the US economy despite its relatively healthy metrics at the time. This discrepancy between US economic performance and many Americans’ negative perception of it persisted into last fall’s presidential election, as evidenced by the new administration’s wide margin of victory.

While optimism initially improved going into 2025 following the election, the first quarter now wraps up with consumer sentiment plummeting a third straight month. The index has fallen from 74.0 to 57.0 since the start of the year, sinking to its lowest level since July 2022, shortly after inflation peaked over 9%. The abrupt change in sentiment amongst small businesses is even more stark. Last December, small business confidence climbed to a six-year high (small business owners tend to lean conservative) only to see February’s small business uncertainty spike to its second-worst reading since 1973.

So far, recent economic alarms have been generally limited to soft data, including surveys and various sentiment indicators. Hard data has remained intact, for now. Time will tell, though, if “Vibesession” proves to be a sufficient description or whether the economy takes a turn for the worse.

In March, the stock market sunk into correction territory and US stocks suffered their worst quarter in 2½ years. What is particularly disconcerting is the recent economic panic appears self-inflicted and even avoidable. Will this administration’s avalanche of sweeping policy changes and ideological reforms produce long-term good or harm?

Old Habits Die Hard

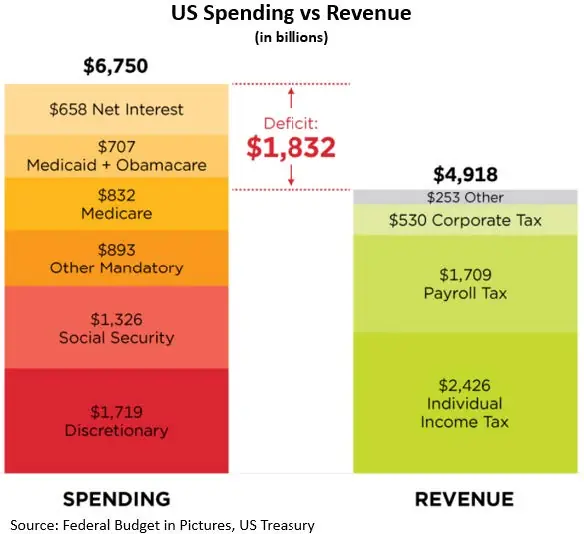

Although concerns related to the United States’ fiscal health are certainly not new, a combination of high interest rates and soaring debt over the past 24 months escalated worries. Last year, the US Federal Government spent $6.75 trillion while collecting just $4.92 trillion in revenue, resulting in a $1.83 trillion shortfall. The current administration campaigned on plans to both reduce spending as well as increase fiscal revenue with the aim of balancing the federal budget, a feat that has eluded the US since 2001.

The Department of Government Efficiency (DOGE), tasked with “modernizing Federal technology and software to maximize governmental efficiency and productivity,” claims to have generated $140 billion in savings as of the end of March. That figure, which cannot be verified, is supposed to include contract and grant cancellations, lease terminations, work reductions, fraud elimination, asset sales, interest savings, and programming/regulatory costs. Numerous analysts and researchers, however, believe the total may be overstated by as much as 5 to 10 times. Others have also pointed to DOGE ignoring lost tax revenue from a smaller IRS and billions of severance dollars paid to laid-off workers. While initially hoping to find savings of $2 trillion to cover the deficit, Elon Musk has now said he is hopeful DOGE can reach $1 trillion in savings. Musk is designated as a “special government employee,” which caps his work at the White House at 130 days. He commented at the end of March, “I think we will accomplish most of the work required to reduce the deficit by a trillion dollars within that time frame.” How he would achieve this feat remains highly unclear, however.

Reshoring United States Manufacturing

Another pattern the current administration is attempting to break is to bring manufacturing back to the US after decades of shifting production offshore.

By the mid-20th century, the US was the world’s supreme manufacturing powerhouse. During the final three years of World War II, the US provided almost two-thirds of all military equipment to the Allies. In fact, by 1945, more steel was produced in the state of Pennsylvania alone than in Germany and Japan combined. That era has now long disappeared. Many US companies began prioritizing offshoring manufacturing in the 1970s as labor costs and easier regulations could be found abroad. By the turn of the century, American offshoring accelerated, and China overtook the US as the world’s leading manufacturing nation in 2010.

Today, China’s global share of manufacturing output is roughly double that of the US. As a more extreme example, to illustrate China’s current manufacturing dominance, in 2022 China built 1,794 large oceangoing ships compared to five ships built by the US during the same period.

Tariffs: A Reshoring Tool to Reduce Trade Deficits

American reshoring came back into focus in 2010 with the formation of the Reshoring Initiative and became a more pressing issue during the Covid-19. The pandemic exposed US companies’ vulnerability to supply chain disruptions and reshoring efforts accelerated. Since 2010, over two million jobs have been brought back to the US.

The current administration is attempting to turbocharge the reindustrialization process by implementing an aggressive tariff strategy aimed at compelling US and international companies to redirect overseas production into America. This will be a challenging process for an economy that has 72% of its economy come from services and just over 10% from manufacturing. Given the US’s large population and relatively high per-capita income, the country’s consumption dwarfs that of other nations.

How Will US Trading Partners Respond?

Due to the enormity of US consumption, tariffs place tremendous pressure on exporters of goods to America. Ordinarily, many could be motivated to seek renegotiating trade terms with the US—either by 1) attempting to persuade the administration to lower US tariffs by reducing their own or 2) retaliate by increasing tariffs on US goods into their own countries. While the response will depend country-by-country, most will likely be disincentivized from raising their own tariffs due to trade imbalances (US has trade deficits with most countries—some exceptions include Hong Kong, Singapore, Australia, UK, Brazil, and the Netherlands) and such action would inflict further harm for both parties.

Their other course of action is to bolster relationships with other trading partners to replace lost sales to the US. Global Trade Alert found that despite the magnitude of US consumption, due to the growth of imports outside of the US, more than 100 economies would likely have fully recovered their lost exports from closure to the US market by 2030 (Mexico and Canada being notable exceptions).

Can the US Even be Reindustrialized?

The other challenge is that tariffs alone are likely insufficient to bring manufacturing back to America. Aside from economic, there were a multitude of social, geopolitical, and regulatory issues that caused jobs to move overseas, not to mention US companies competing with one another domestically. There is also the complexity of untangling a web of global suppliers and addressing the relatively high cost of labor and production in the US. Furthermore, the decline in American manufacturing over many decades has also resulted in a corresponding decline in skilled labor. A report from the Deloitte and The Manufacturing Institute found that there is a skills gap that could result in 2.1 million unfilled jobs by 2030, which would include not just traditional manufacturing roles but automation, robotics, and data analytics.

What is the End Goal?

President Trump and his administration have stated multiple objectives of the tariffs, some of which detract from one another. His counselor, Peter Navarro, has said that the tariffs could raise up to $700bn in fiscal revenue a year, which could theoretically offset a good portion of the federal deficit and potentially subsidize lost revenue from extending the Tax Cuts and Jobs Act.

The President has also discussed reindustrializing the US, urging both American and foreign companies to bring production onshore. In addition to using tariffs as a form of punishment for producing overseas, he has discussed seeking to lower the corporate tax rate and reduce regulation to attract business investment into the US.

A third objective could be strategic—using the threat of tariffs to coerce foreign countries to lower their tariffs on US goods and abandon non-tariff trade barriers such as VAT taxes, currency manipulation, and government subsidies.

Ultimately, the administration’s end goal could be some combination of all these objectives. They will need to tread cautiously though; the long-term effects of these policies remain unclear and the blowback could be powerful.