The new year is upon us. This year 66% of Americans have committed to a financial New Year’s resolution, but as we know, only a slim margin will walk into 2024 having achieved their goals. Before you take on a lofty financial challenge, consider whether you have met the basic financial planning considerations. To help you get there, we’ve organized a helpful (and downloadable!) financial planning checklist to help you stay focused and on track with your personal financial goals this year.

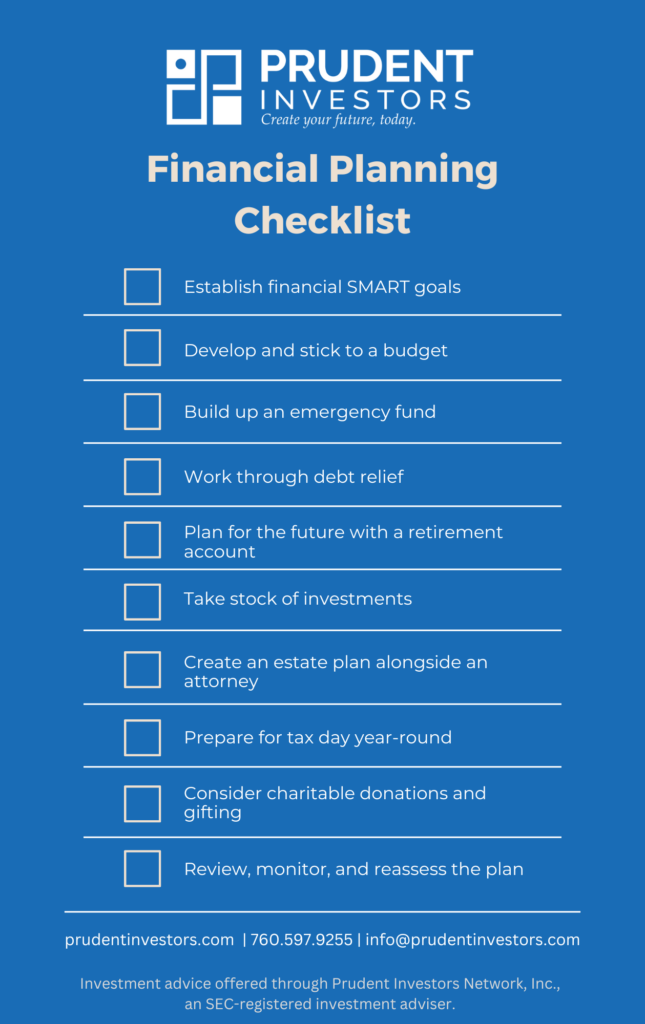

Financial Planning Checklist

Establish financial goals

Develop SMART goals relevant to you and your financial matters. This means setting goals that are specific, measurable, attainable, realistic, and timebound.

Goals can’t be achieved unless you have the means to achieve them. Let’s take savings for example. Most Americans are used to committing to a specific number and working year round to meet that goal, sometimes falling short in the process. By establishing a SMART goal you break down the goal in order to help you meet different milestones. Instead of simply stating you plan to tuck away $12,000 in savings by year end try something like this.

Following all monthly expenses and investments, I plan to distribute $1,000 at the end of each month into my savings account. In order to achieve this goal, I will reduce my “entertainment” and “food and beverage” expenses by 10% each month and assess my budget once weekly to ensure I am on pace.

Develop and Stick to a Budget

Budgeting should top any solid financial planning checklist. It is arguably one of the most important parts of financial planning as it provides keen insight into your expenses.

We recommend assessing your budget regularly using an app like Mint or YNAB, which will capture your spend by category, such as food and beverage, mortgage, and utilities. If you are a Prudent Investors client, you also have access to free budgeting software within our financial planning tools. Categorizing spend is an excellent tool to make better budgeting decisions. Too much spend in your shopping budget? Commit to lowering it next month or using any decrease in your utility spend to pay off the debt.

Build up an Emergency Fund

Experts agree that you should have between 3 to 6 months of expenses tucked away in your emergency fund. Yet 55% of Americans can’t cover an unexpected $1,000 bill. Creating, or bulking up, your emergency fund is crucial to ensure you don’t end up in financial turmoil.

So how do you build up your emergency fund? Enter SMART goals. Use this method to establish timely and consistent contributions to your emergency fund account. Consider starting with the goal of reaching one month worth of expenses. Once that’s achieved, snowball that progress into the next milestone.

Remember that emergency funds should be liquid, so it’s best to hold them in an account with easy access.

Work Through Debt Relief

Most of us struggle with the sticky balance of where to allocate extra monthly funds. If your emergency funds are maxed out and you’ve set up consistent distributions into your retirement account, it’s time to consider paying off debt.

Before you begin, it’s important to take stock of what debt you have, i.e. mortgage, car loan, credit card payment, and student loans. While there is no one method that works universally, there are a few that have proven to help lower overall debt. Take for example the snowball method, which works by paying debt from smallest to largest and rolling the money you’ve put toward each payment into the next outstanding debt.

It’s also recommended to pay above the minimum monthly payment, which will help you save on interest.

Plan for the Future with a Retirement Account

Think beyond your current financial situation. How early do you plan or want to retire? Once retired, will you have enough savings to lead the same lifestyle you once did? Starting or bulking up your savings is a fantastic way to plan for the future.

We’ve covered an in-depth look into what type of retirement account is best for you, from a company sponsored 401(k) to a SEP IRA. But, if you’re still unsure where to start, consider reaching out to a qualified financial advisor who can help you land on a retirement plan that works best for your situation.

Remember, different retirement accounts have different tax advantages so you’ll want to consider when and how you’re taxed, either now or in the future. The start of a fresh new year is also a great time to consider whether you can increase or maximize your contribution amounts, which may help you reach your retirement goals faster.

Take Stock of Investments

If you’re already investing beyond a retirement account, you’re off to a great start. Start the new year by reviewing your investments, preferably with an investment advisor, to ensure your investments are well diversified and your risk tolerance matches your investment goals. This is also a great time to consider any liquidity needs should you need cash on hand for an important purchase, like a home or vehicle.

If you’re new to investing, no worries. An investment advisor can help you establish investment goals and create an investment policy statement (IPS) that identifies your assets, objectives, and overall goals. This document provides guidance for investment decisions in achieving your long term goals.

Establish an Estate Plan

Now that you’ve figured out your day-to-day expenses, secured long term investments, and planned for retirement, it’s time to build an estate plan.

An estate plan is a set of legal documents and instructions that give guidance on how you want your assets to be distributed upon death. Documents within an estate plan include a will, living trust, advanced healthcare directives, power of attorney, titles and deeds, and any other key information that will be helpful to beneficiaries or successor trustees.

Creating an estate plan can be complex and likely cannot be fully completed on your own. An estate planning attorney can work with you to help build your estate plan based on your needs. To get a head start, consider who will be the beneficiary or beneficiaries of your estate and itemize any known assets, like property, vehicles, checking accounts, savings accounts, and personal belongings.

If you’ve already created an estate plan, this is a good time to take stock of any important life changes and update your documents as needed.

Tax Considerations

Tax Day comes all too fast each year, which often leaves many scrambling to recount any tax qualified expenditures or pull important tax-related documents. From the start of the year you have four months to prepare for tax season, so now is the time to get in gear and speak with your tax accountant about your overall tax strategy.

While it may be too late to plan ways to reduce your tax liability for this season, your tax accountant or financial advisor can help you identify different strategies for next tax season, like tax-loss harvesting, gift tax exclusions, or charitable contributions.

Benefit yourself by being fully in the know on your taxes and potential deductions. Reducing your tax liabilities can save you hundreds or thousands of dollars each year.

Consider Charitable Donations and Gifting

Remember the old adage that it’s better to give than receive? Follow that advice as it pertains to your income, as well. Charitable donations should be a staple on your yearly financial planning checklist. Giving – whether monetarily or through any other means – helps benefit both you and the receiver(s) as the IRS allows individuals to deduct up to 60% of your adjusted gross income via charitable donations. Generosity has also been proven to lower blood pressure and protect your ticker.

Gifting, on the other day, is quite different. As characterized by TurboTax, a gift is a transfer of property for less than its full value. As of 2022, the present-interest gift maximum is $16,000. This means the giver can gift up to this amount without triggering the gift tax. There are, however, exclusions and limitations to the gift tax rules, such as charitable donations, gifts to a spouse, or gifts for educational purposes.

The advantages of gifting, beyond the simple pleasure it may bring, are worthy of consideration. Gifting can help lower estate taxes and reduce income taxes. If you’re in a position to consider gifting, speak with your tax advisor or investment advisor to ensure you are not exceeding the annual gift exclusion amounts.

Review, monitor, and reassess

Once your financial planning checklist is complete it’s time to work the plan. But just because you’ve secured investments and created an estate plan it doesn’t mean your financial planning checklist doesn’t need constant review and tweaking. The plan will only work if you work the plan and adjust as needed.

To ensure you’re continuously achieving your financial goals, consider which cadence of check-in works best for you. Some may prefer monthly check-ins, while others may dive in quarterly. Whatever timeline, it’s important to implement checkpoints throughout the year to review, monitor, and reassess your goals, investments, and tax strategy. This will help you more easily course correct should your approach need a different path.

Start the new year off right by using this financial planning checklist to get your finances in order and on the way to meet your short and long term financial goals. You can download a copy of our financial planning checklist here. We recommend using this as a guide during your next financial planning meeting.

Looking to partner with a new financial advisor who can better walk you through each step of the financial planning checklist. Connect with our team of expert advisors to jumpstart your goals.

This blog is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this blog including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Prudent Investors. Prudent Investors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.