“It is during our darkest moments that we must focus to see the light.”

– Aristotle

In May of this year, the New York Times published an article about authors, Neil Howe and Bill Strauss, who wrote a book in 1991 called “Generations” that predicted what they called, “The Crisis of 2020.” Howe and Strauss said the crisis “could rival the gravest trials our ancestors have known” and serve as “the next great hinge of history.” While not being specific, they thought it could be an environmental catastrophe, some nuclear threat, or “some catastrophic failure in the world economy.”

Three decades later having just wrapped up arguably the world’s most challenging year of the 21st century, their words those years ago describing 2020 now look prescient. The last ten months have extracted a heavy toll on humanity. The global pandemic has claimed millions of lives around the world and the emotional and financial effects have been far-reaching and devastating. Political ideologies have become the most divided in decades and sadly the quality of our social discourse is increasingly marred with growing mistrust and cynicism.

While we remain trapped in a dark whirlwind of spiking case numbers, overloaded hospitals, and state shutdowns, we enter 2021 with a glimmer of hope as vaccines are starting to roll out that show generally encouraging signs. Furthermore, businesses and households can now function more adeptly in a social-distanced environment and many industries have developed new ways to be more efficient and resilient than ever before. For now, each of us would do well to remain optimistic and focus not on the darkness that currently surrounds us, but on the light that lies ahead.

How was the Market so Resilient in 2020?

With 5 million more Americans unemployed now compared to a year ago and full year 2020 corporate earnings expected to suffer its largest decline since 2008, one could understandably be surprised by the stock market’s performance last year. The S&P 500 rose over 16% in 2020; this is well above the index’s annual average of 10% and comes despite a 34% decline in February and March. So how did this happen?

1) Historically low interest rates: Two emergency rate cuts from the Fed in March that took the Fed Funds rate to 0% (lower limit) and a flood of accommodative monetary measures brought interest rates to the lowest levels in the nation’s history, boosting stocks and the price of other risky assets as valuation multiples shot higher.

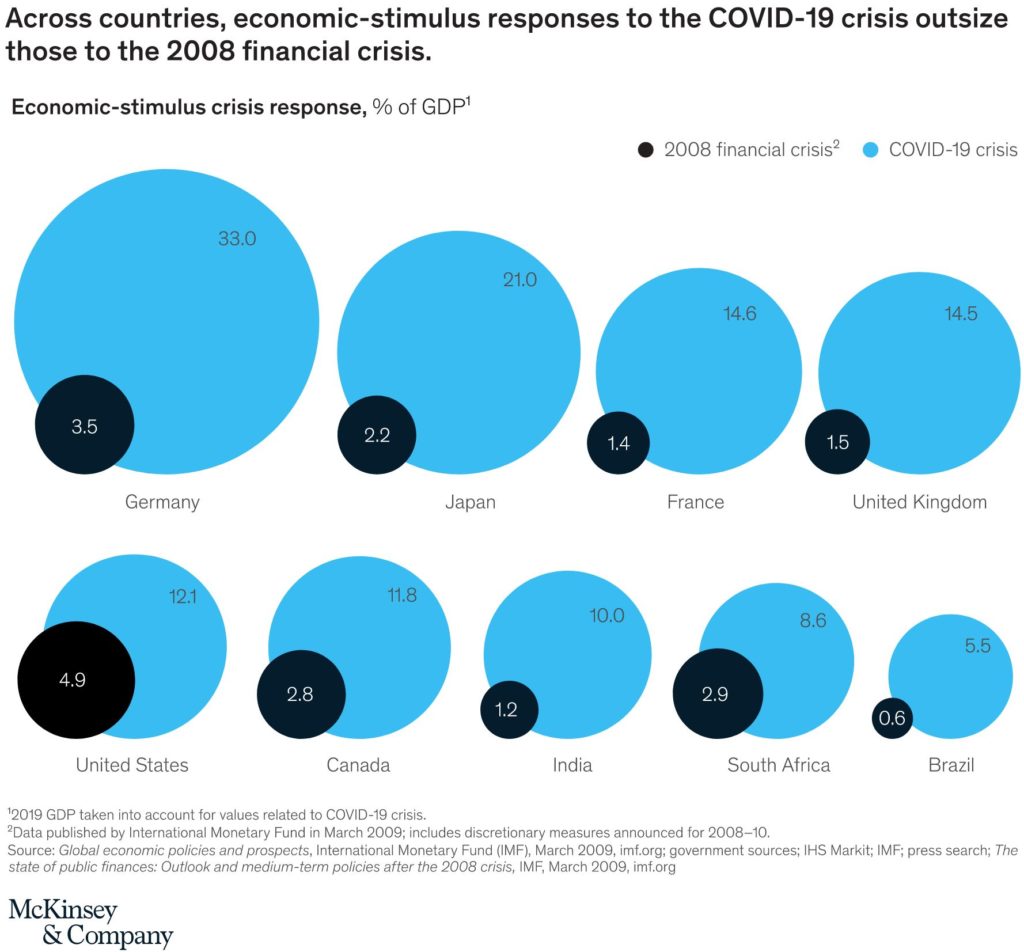

2) Unprecedented fiscal stimulus: The US federal government provided $3.5 trillion of Covid-related stimulus and tax relief in 2020 with another $900 billion on the way. While some may debate the effectiveness of fiscal stimulus, it is indeed the case that the US consumer remained resilient in 2020. Consumer spending, which makes up the majority of the US economy, not only recovered but even grew from pre-crisis levels. The US’s economic response, though drastic, was not unique. A number of other countries spent comparably and in some cases even more relative to the size of their respective economies.

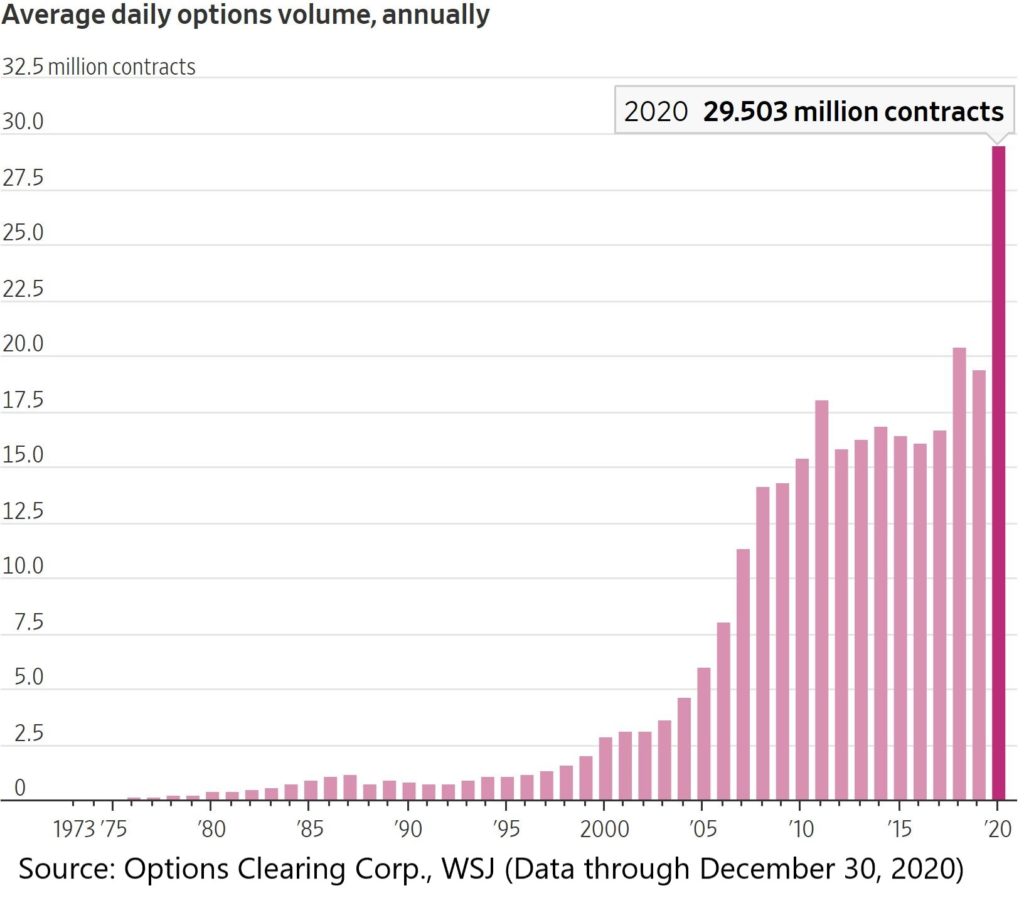

3) Abundant optimism: There has been an abundance of investor optimism in recent months. At the end of October, Goldman Sachs reported that median short interest for S&P 500 stocks fell to its lowest level since 2004. Then in November, Bank of America’s Fund Manager Survey indicated both economic and profit growth expectations reached their highest levels since 2002. Additionally, this year investors sought to magnify their exposure to the rising stock market through leveraged call options and 2020 saw an explosion in average daily volumes. These factors all pointed to investors’ willingness to take on more risk throughout the year.

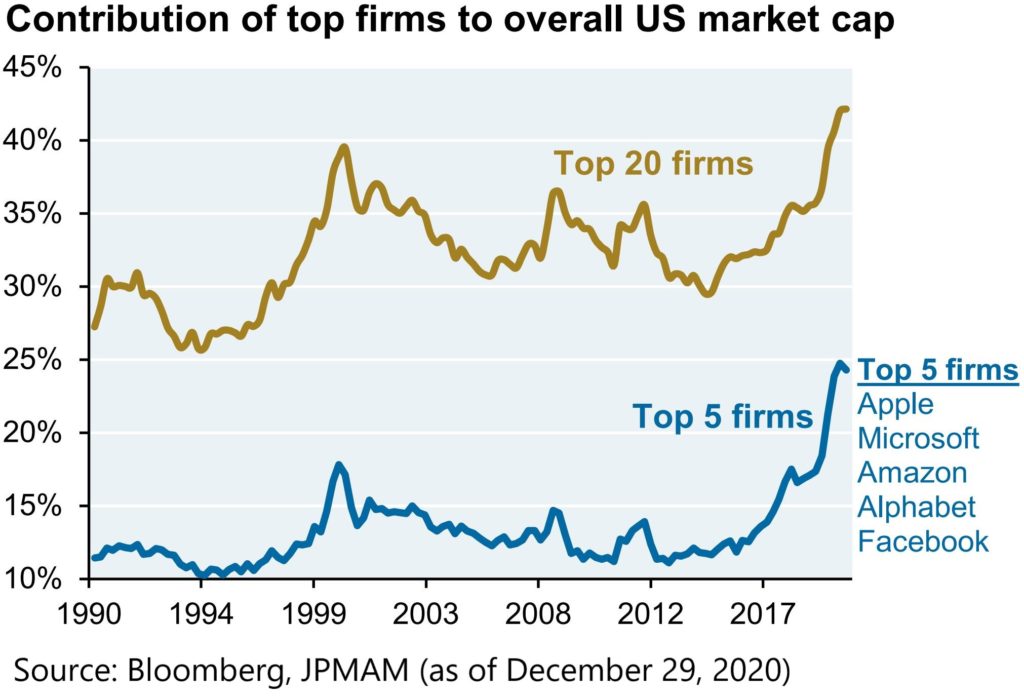

4) Outliers pulled up the averages: The top 50 companies in the S&P 500 returned nearly 90% in 2020, more than 5x the broader index. Speaking of outliers, 48 listed companies (not just S&P 500) were up at least 400% at their yearly peak. By comparison, in 2019, when the S&P 500 rose nearly twice as much, only 13 companies rose as much as 400%. Such top-heavy performance has pushed the corporate giants to occupy a particularly disproportionate share of the market. The five largest US companies now make up ¼ of the S&P 500 market cap, a number that historically fluctuated between 10-15%.

Craving to Spend the Savings

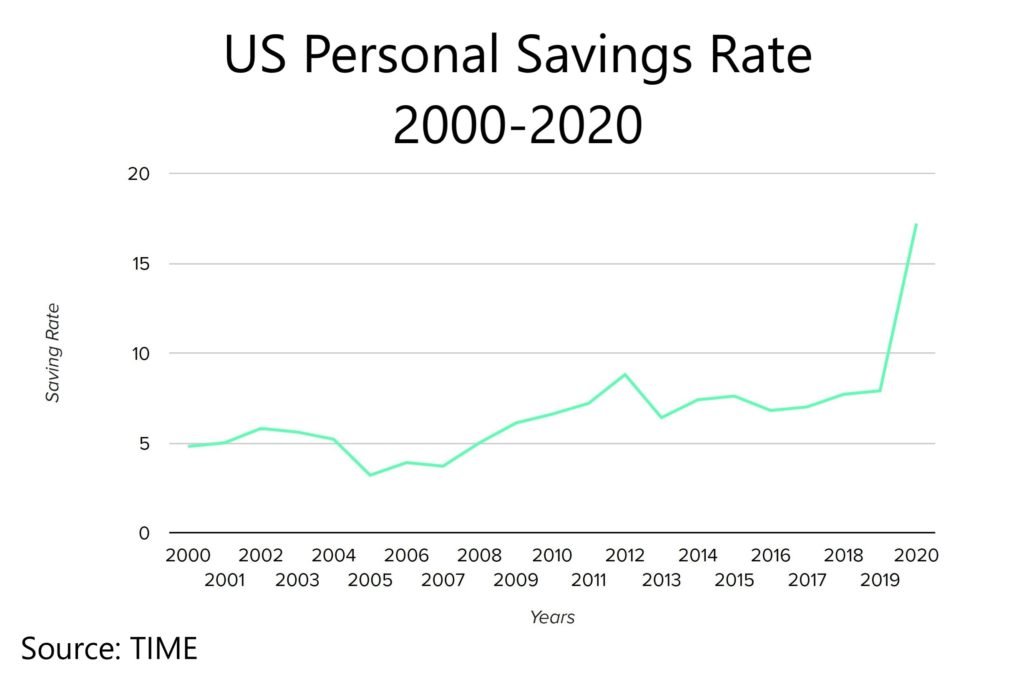

Amidst the slew of negative news last year, there was one key issue that has largely been underreported: Americans’ savings soared in 2020. While the stimulus was certainly vital for many households, admittedly for many others it was akin to parents increasing their children’s allowance and then grounding them from going out and spending it. This combination of higher disposable income and lower spending during the shutdown resulted in some of the highest savings rates seen in decades.

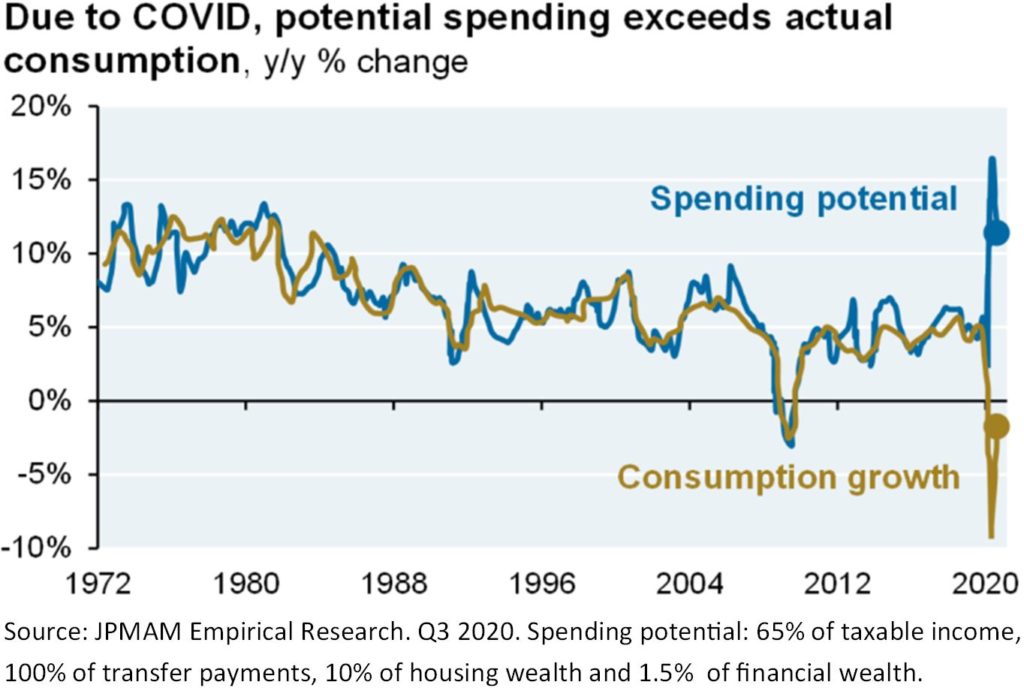

During the months of March to November, the New York Times reported that total disposable personal income increased $1.03 trillion compared to the same period the year before. 80% of that increase is attributable to the CARES Act, in the form of unemployment benefits, stimulus checks, and PPP loans. Meanwhile, due to the lockdowns, spending plunged. Total household spending fell by $535 billion over the same period, primarily from the services sector. This would include money not spent on restaurants, flights and hotels, concerts and sporting events, and a myriad of other recreational activities. For the first time in decades, Americans’ spending potential dramatically exceeds actual consumption. The prospect of restless citizens with extra money to spend has the potential to unlock a dramatic rise in consumer activity once businesses and services eventually resume more normal operations.

Signs of a V-Shaped Recovery

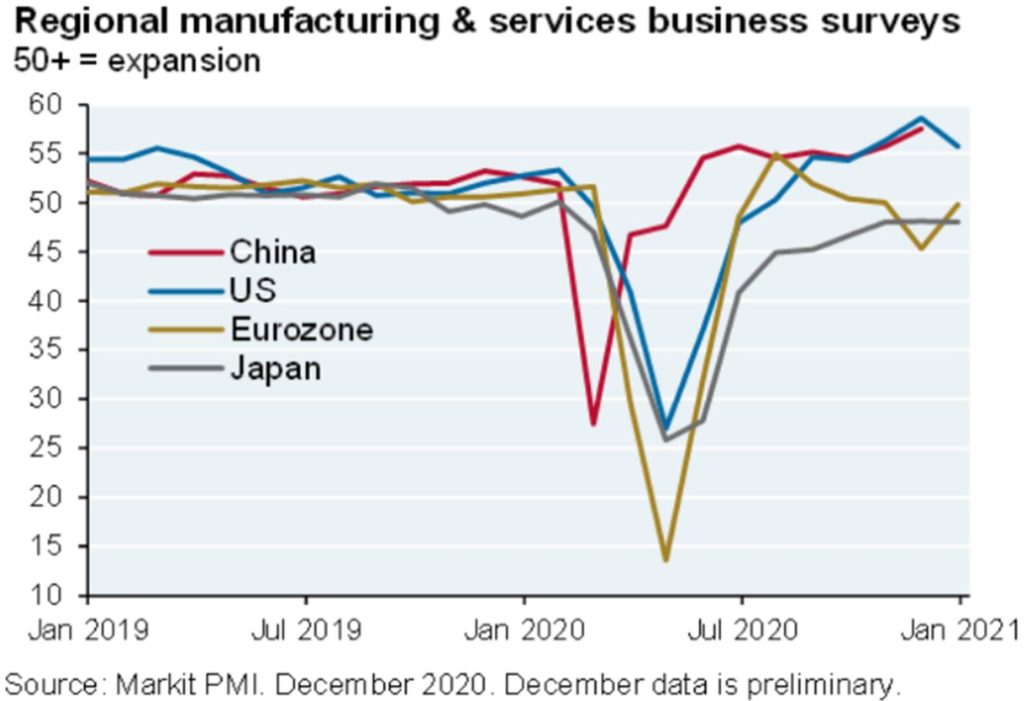

Notwithstanding the continued Covid case numbers, there have been signs that a V-shaped recovery is underway. China’s manufacturing and services activity is already higher than before the pandemic and the US is following a somewhat similar path while being a just few months behind.

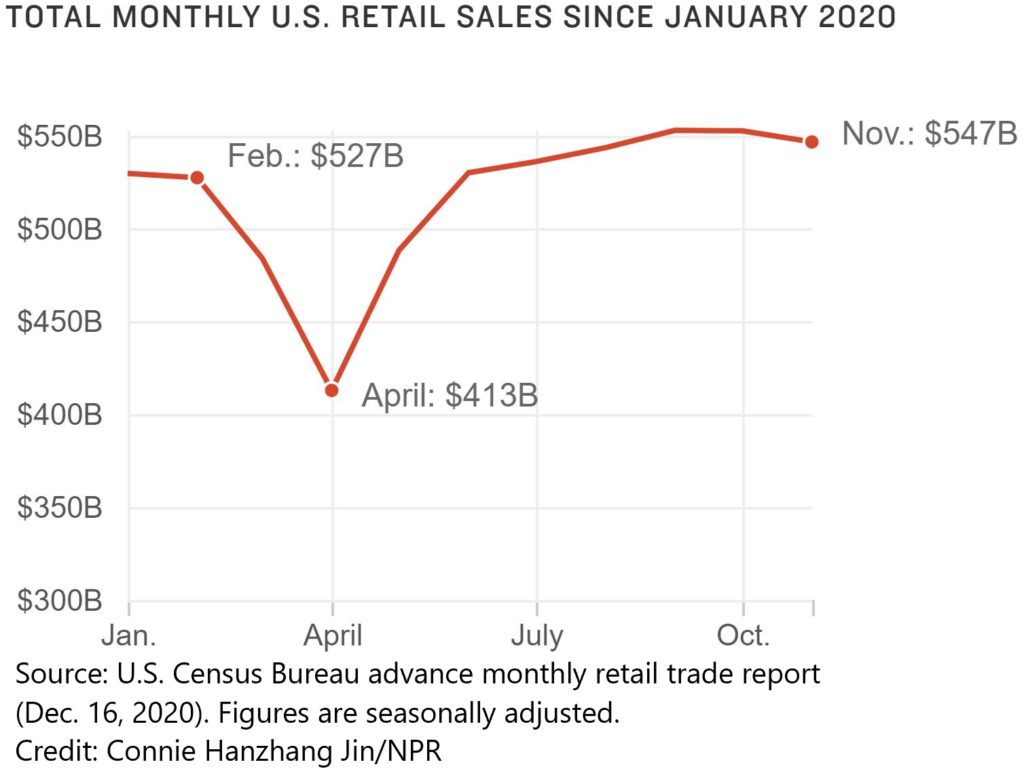

According to the Wall Street Journal, after net job losses of 9.4mm in the US in 2020, economists are predicting what would be record job growth in 2021. IHS Markit, Oxford Economics, and the University of Michigan forecast job gains of 6.7, 5.8, and 5.3mm, respectively. This would surpass the previous record of 4.3mm jobs gained in 1946. In terms of consumer activity, retail spending has picked back up to exceed pre-pandemic levels for several months now.

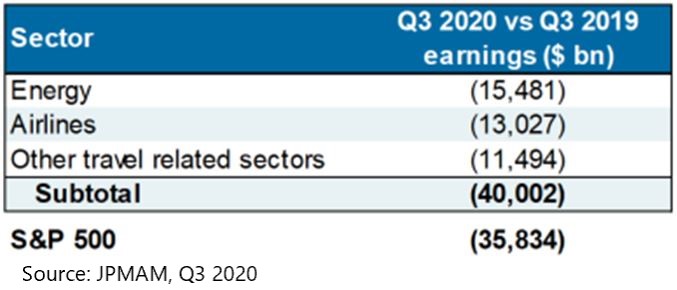

Corporate earnings have also been resilient. According to JP Morgan, although earnings were down in Q3, the entire decline was attributable to just three sectors: energy, airlines, and other travel related businesses. Other sectors collectively were actually up compared to the same period in 2019.

A Favorable Financial Climate

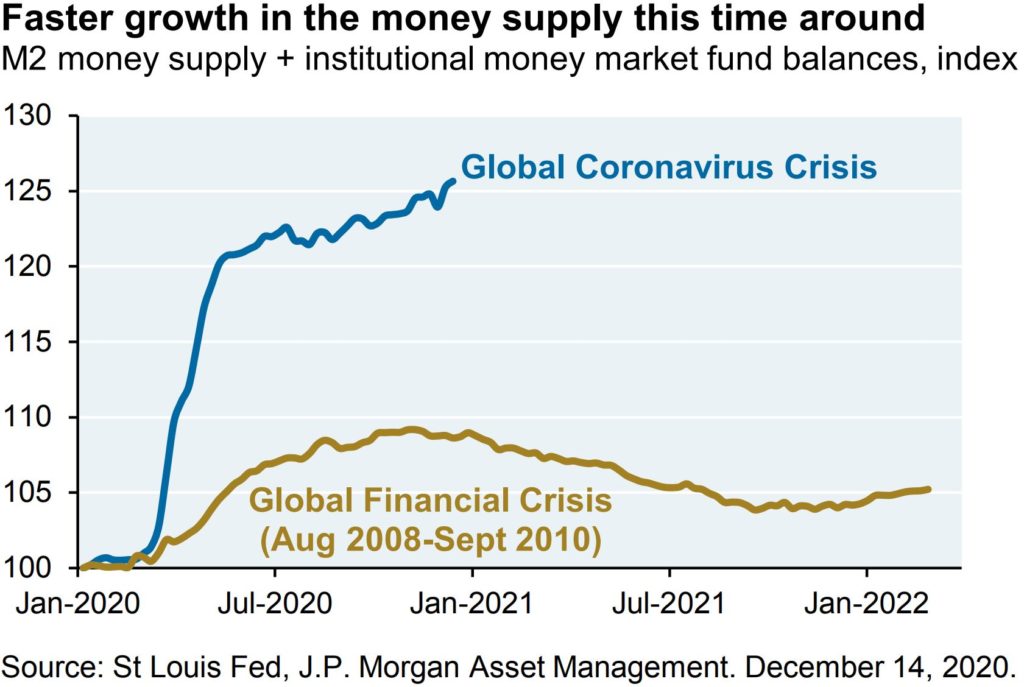

With the Federal Reserve pledging to keep rates low and Congress intent on pumping more stimulus into the economy, this accommodative regulation may create an ideal climate for risk assets to continue to grow in the coming months. Despite the vast sums of new money being created, the Fed has made it clear that inflation is not a concern. The central bank has said it will likely keep its benchmark interest rate pegged near zero at least through 2023, and that it will actually more aggressively pursue pushing inflation above its 2% target, as inflation has fallen since the pandemic and would even be a welcome development.

Congress, meanwhile, has passed its $900 billion Covid relief package and there is scope to substantially increase the amount further under a unified Democratic government. The Democrats have vowed to increase the stimulus payments from $600 to $2000 and send the checks out to Americans expeditiously and more stimulus is likely to come. Goldman Sachs raised its Q1 stimulus forecast to $750 billion following Georgia’s runoffs. The financial conditions set by policymakers should be supportive for investors.

Nevertheless, while financial accommodation has its benefits, what began as a medical issue will ultimately require a medical solution. The success of the economic recovery hinges on the success of distributing and administering an effective vaccine.

The Vaccine Rollout

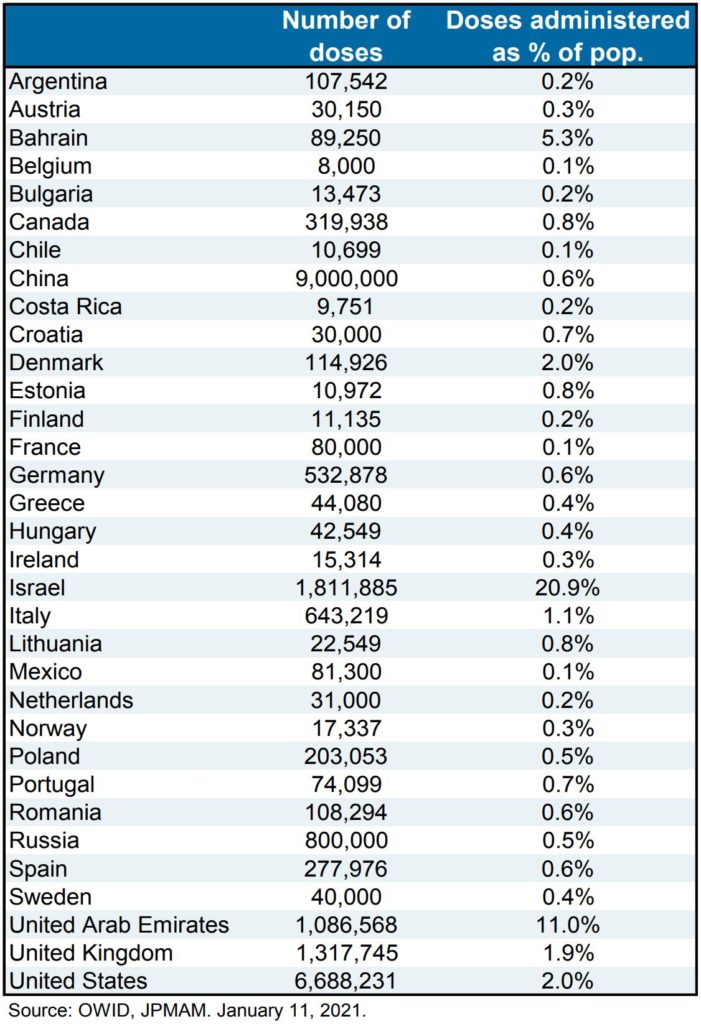

While the vaccine was able to be approved and fast-tracked earlier than some had expected, the administration of it is starting slower than many had hoped. According to the CDC, 22 million doses have been distributed in the US but only 6.7 million administered, equating to just 2% of the population. This is short of Operation Warp Speed’s goal to inject at least 20 million Americans with their first shots by the end of last year and behind the target to inject 80% of America’s 330 million people by late June to achieve herd immunity.

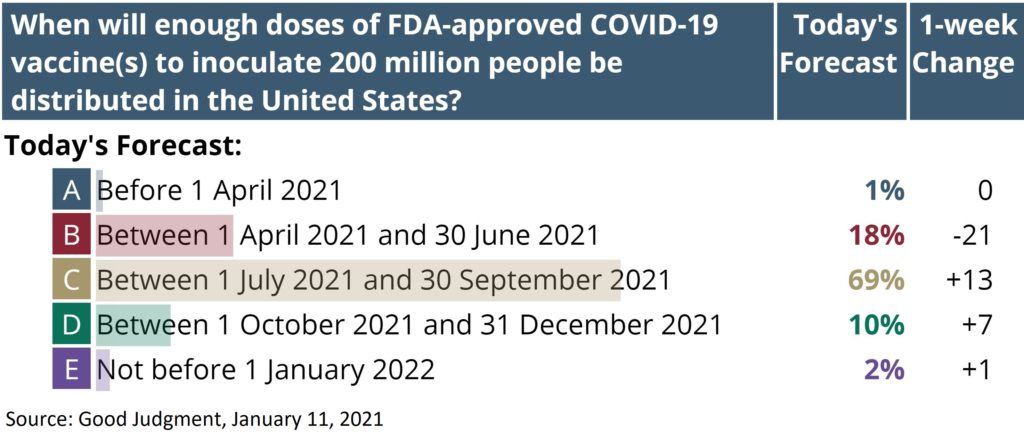

So why the delays? First, months of debate in Congress over the much-needed coronavirus relief package resulted in federal money only finally starting to flow to states in recent days, according to Axios. Second, hospitals are responsible for the administration of initial doses to health care workers but their efforts have been set back being overwhelmed by the flood of Covid patients. Third, limited supply has necessitated the need to prioritize certain groups and individuals, creating additional administrative barriers. The current hope is 200 million Americans can be vaccinated by the end of September, according to estimates from superforecasters, Good Judgment.

While the US is struggling with the vaccine rollout, similar challenges are being faced around the world. So far, just just around 15 million people have been vaccinated globally, compared to a population of 7.8 billion.

A Unified Government but Still in Check

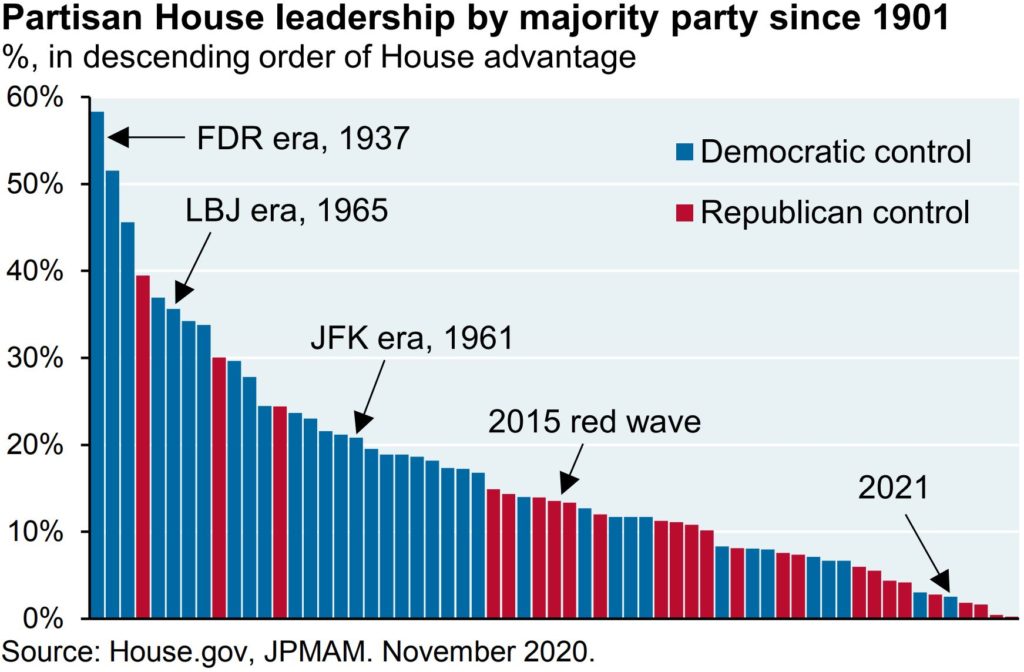

Although the Democrats will take control of the three chambers in the coming days, they may have somewhat limited scope to make the legislative changes the Biden administration has laid out. JP Morgan points out that the partisan balance across Federal and local branches of government is split almost evenly 50/50, and that the Democratic edge in the house is among the smallest seen since 1901. This razor-thin advantage means that passing new policy, particularly related to taxation and regulation, may prove to be less straightforward for the Democrats than some might expect.

A Recipe for a Sustained Recovery

There remain challenges as the world copes with growing Covid numbers, mutated strains, overloaded hospitals, and more recently, an attack on our nation’s capitol that raised more questions than answers. But there are also plenty of factors pointing to a sustained recovery as we eventually work through this dark time. The combination of more potential stimulus, more disposable income, an accommodative Fed and Congress, more friendly trading relationships with foreign countries, and vaccines coming online has prompted some economists to significantly raise their outlooks for this year as well as the years to come. Nobel laureate Paul Krugman predicts the next few months “will be hell in terms of politics, epidemiology, and economics.” But he also expects the economic recovery will be “much faster and continue much longer than many people expect.” We started this newsletter with a quote from one Greek philosopher so let us finish with another. Socrates said, “The secret of change is to focus all of your energy, not on fighting the old, but on building the new.” Let us hope we learn from the experiences of 2020 and build a better future starting in 2021.